Email marketing is one of the most effective ways to engage customers and drive conversions, and it’s especially valuable in industries like insurance. However, with so many opportunities available, it can be challenging to know where to start. That’s where smart email marketing strategies come in.

In this post, we’ll break down what makes email marketing for insurance companies unique and share actionable tips to help you optimize your insurance email marketing campaigns. These insights will help you build stronger connections with your customers and improve your results.

Why is insurance email marketing important?

Email marketing for insurance agencies is crucial because it lets them build trust, stay connected with customers, and drive conversions in a highly competitive and relationship-driven industry. Let’s take a closer look at the key reasons why it matters so much:

- Long-term customer relationships. Insurance is a long-term product people rely on for years, so staying in touch is key. Email marketing keeps your company top-of-mind with regular, helpful updates, which is essential for fostering customer loyalty and renewals.

- High open rates. According to a recent survey, the average email open rate across all industries typically ranges from 30% to 40%. The insurance sector performs above average, with a rate of 44.27%, which means that insurance customers are engaged with email content.

- Customers’ education. Since insurance can often be confusing, emails are an effective way to educate clients on policy details, claim procedures, new regulations, or ways to save money.

- Important updates. Reminder emails about upcoming policy expirations or renewal options help prevent churn. Timely communication makes it easier for customers to renew without hassle.

- Better personalization. Email marketing for insurance companies allows you to segment your audience based on behavior, demographics, or policy type. This enables you to send highly targeted, relevant content.

- Cost-effective communication. Compared to direct mail or phone calls, email is far cheaper and easier to scale. You can reach thousands of clients instantly with minimal cost.

- Cross-selling and upselling opportunities. You can send emails to suggest additional products, such as offering homeowners insurance to a customer who already has auto insurance.

- More feedback. Surveys and feedback forms sent via email provide valuable insights into customer satisfaction, helping you improve your services.

- Communication in critical moments. In emergencies, such as natural disasters, emails can provide quick updates on claim processes, available support, and contact information.

As you can see, insurance email marketing is a vital communication channel that helps you stay in touch with your customer base, build trust, and foster long-term engagement. Ultimately, this can lead to increased customer loyalty and revenue.

Types of insurance newsletters

With plenty of reasons to incorporate insurance email marketing into your communication strategy, it’s also helpful to know the most common types of emails you can send. Each type serves a unique purpose, audience, or product. Let’s explore several categories to help you understand your options and choose the right mix for your strategy.

Educational newsletters

Depending on your area of focus in the insurance industry, there are many valuable topics you can share with your mailing list. The goal is to build trust and position your brand as a helpful resource by making complex insurance topics more accessible and easier to understand.

A good starting point is to identify the most common questions your clients ask and address them through insurance newsletters. Examples include explaining the difference between deductibles and premiums, when and why to update a policy, or breaking down what umbrella insurance covers.

Promotional newsletters

Like in any other industry, targeted promotional emails are a powerful tool for cross-selling, upselling, and bundling your services. Email marketing for insurance agencies also allows you to announce new products or limited-time offers directly to your clients.

Content ideas for promotional insurance emails may include limited-time discounts on auto or home policies, bundled insurance packages, and new product announcements. Highlighting these offers helps clients save money, simplify coverage, and find solutions tailored to their needs.

Policy update newsletters

Updates and changes to existing products and offerings are of utmost importance, and it’s essential to communicate them clearly to avoid confusion or frustration. Insurance email marketing helps keep your clients informed about changes that may affect their coverage.

Several scenarios fall into this category. For example, new laws or regulations, updates to policy terms or benefits, price increases, and renewal reminders with clear next steps.

Risk management newsletters

While similar to educational content, these emails are typically more targeted. You can segment your audience and send practical advice related to claims and risk prevention, based on the products they have, the time of year, or other relevant factors.

Topics for such insurance emails might include tips on what to do after a car accident, how to reduce home fire risks, or how to prepare for storm season. The main goal of this type of insurance email is to help customers reduce risk and feel more confident navigating the claims process.

Seasonal or event-based newsletters

Seasonal insurance emails help you stay timely and relevant. Certain types of insurance, such as travel coverage, might not always be top of mind. However, during peak seasons, your reminder can be exactly what your clients need, so it’s essential to keep your clients informed of this offering and provide direct links to a page with more information on how to obtain it.

Seasonal or event-based newsletters can cover topics such as a back-to-school insurance checklist, holiday travel coverage, end-of-year policy review reminders, and other relevant issues.

B2B newsletters

If you work with corporate clients, email marketing for insurance companies offers a great way to deliver value through dedicated B2B newsletters. These emails let you highlight your value proposition by sharing informative articles or exclusive tips on securing the best coverage.

Depending on your product line, topics could include workplace liability coverage, employee benefits updates, or cybersecurity insurance trends. This helps you stay relevant while demonstrating how your services support business goals.

Client onboarding newsletters

Starting with a new insurance provider can feel overwhelming for customers. That’s why a thoughtful onboarding email series can make a big difference. These newsletters help new clients understand what to expect and how to get the most from your services.

Content ideas include a welcome message, instructions for accessing a client portal, tips for filing a claim, and an introduction to their dedicated agent. A smooth onboarding process sets the tone for a positive long-term relationship.

Thank you newsletters

As in any industry, thank-you emails can strengthen client loyalty. When tied to anniversaries or milestones, they offer a thoughtful way to show appreciation and acknowledge your clients’ continued support.

In insurance email marketing, this could include a personalized message, a year-in-review summary, or a small reward, such as a discount on future services. These gestures go a long way in building stronger relationships.

How to effectively use email marketing for insurance agencies

Using email marketing for insurance companies requires a combination of strategic planning, personalized communication, and automation. In this section, we’ll cover several practical tips across key areas that you can start using right away.

Grow a quality mailing list

Before launching any campaign, start by building a small but high-quality mailing list. If you’re unsure how to get potential clients to subscribe to your insurance newsletter, try these proven methods.

Consider offering a lead magnet — something useful in exchange for a client’s email address. For example, create downloadable freebies like “10 Things to Know Before Choosing Life Insurance” or a “Home Insurance Checklist.” You can also create interactive quizzes, such as “What Type of Insurance Do You Really Need?” Simply ask visitors to enter their email address to receive the results or download them.

Another method would be to implement insurance chatbots, pop-ups, or forms on your website. To encourage sign-ups, it’s essential to offer a clear value proposition, for instance, “Get expert insurance tips monthly + exclusive policy discounts.”

If possible, consider hosting webinars or workshops to engage with your audience. These events not only educate your audience but also help you collect email addresses during registration.

Automate email campaigns

Insurance marketing automation is just as important as email marketing itself. It helps you engage with your audience at the right time with the right message. To get started, you’ll need an email marketing platform that supports automation.

A good first step is setting up a welcome flow that introduces your agency and outlines your services. You can also send educational content, client testimonials, and case studies to build trust and guide prospects through the buyer journey.

Drip campaigns based on subscriber interests are another powerful automation strategy. For instance, if someone downloads a life insurance guide, you can automatically follow up with a targeted email series about coverage options, pricing, and benefits.

In insurance email marketing, renewal reminders are especially crucial. You can schedule automated emails to go out 30, 15, and 5 days before a policy expires. Platforms like SendPulse make it easy to create insurance renewal email templates in just a few minutes.

Segment your mailing list

Segmentation can significantly improve your engagement and conversion rates. Consider organizing your mailing list by:

- policy type (auto, home, life, health, business);

- buyer stage (new lead, in consideration, current client, renewal stage);

- demographics (age, family status, occupation);

- geographical location (city, state, region);

- engagement (open rates, click-through behavior).

For instance, you might send home insurance tips for hurricane season to homeowners in coastal regions or a policy upgrade offer to clients whose renewal is approaching.

Craft effective insurance emails

A strong subject line increases the chances of your email being opened. Use urgency or curiosity to make it stand out in a crowded inbox. Keep it short and focused on a benefit, such as “Save up to 15% on Your Auto Insurance Today.”

Make sure the body of your email reflects your agency’s tone of voice. Use a clear and direct call to action to guide the reader. If available, include social proof like testimonials or client reviews to build trust and credibility.

Ideally, aim to send your insurance newsletters two to three times per month. Consistency is key, but avoid overwhelming your subscribers. Sending emails too frequently without delivering clear value may lead to frustration and increased unsubscribe rates.

Test and optimize

As in any other industry, insurance email marketing requires constant testing and optimization to identify shifting audience interests and stay relevant over time. Always analyze key performance metrics such as open rate, click-through rate, conversion rate, and unsubscribe rate.

A/B testing your email campaigns can be especially helpful. Regularly test different subject lines, CTAs, images, and send times to determine what works best.

10 insurance email marketing examples

In this section, we’ll review some great insurance email examples. We’ll explore what makes each one effective and why it works so well. You can then use these examples as inspiration when creating your own email templates.

Virtual Shield

Virtual Shield designed an insurance newsletter that clearly outlines its services and the importance of online identity protection. The email explains what the insurance covers and offers step-by-step setup guidance.

It also features a discount offer and clear call-to-action buttons, allowing users to register and select a plan. There’s also an option to contact customer support directly.

Farmers Insurance

This insurance email shares useful risk management tips, especially relevant during the COVID-19 pandemic. The email also includes essential information about using Farmers Insurance, including safety guidelines, contact information, and service hours, all in a clear, accessible format. The CEO’s signature at the end adds a personal touch, helping the formal tone feel more human and authentic.

Delta Dental

Delta Dental’s insurance newsletter encourages subscribers to explore and choose a dental plan. Clients can click a button to view available plans and explore ways to reduce their dental care costs. The clean layout and clear language make the email easy to read.

A CTA button takes users to the plan selection page, while the email footer includes legal information to ensure compliance with applicable laws.

Money

Money created an email focused on pet insurance, addressing the most important questions on the topic. Each section tackles one key concern, making the email easy to skim and understand. Concise answers to common questions help subscribers make informed decisions. A CTA button placed under the headline allows readers to immediately search for a suitable insurance plan.

It’s also worth noting that the insurance email includes a disclaimer in the footer, stating that it is an advertisement. Depending on the laws in your country, a disclaimer like this may be legally required when promoting products or services.

An excerpt of an insurance email from Money

An excerpt of an insurance email from Money

Airbnb

While Airbnb isn’t an insurance company, it uses email to promote insurance from its partners. This is a great example of upselling: users can book accommodation and add insurance in one place. The email breaks down what’s included and emphasizes 24/7 support. For travelers, this reassurance can be a major selling point.

SoFi

To mark National Insurance Awareness Day, SoFi sent an educational insurance newsletter. It introduces subscribers to various types of insurance, including term life, auto, and cyber insurance. Each section includes a brief explanation, along with a link that allows subscribers to apply for the type of insurance they need.

Simply Business

Simply Business created a special insurance email celebrating 2021 and its key achievements. This insurance company provides an overview of the year, including the number of clients served, content shared, and key milestones reached.

The newsletter links to selected Simply Business articles to encourage subscribers to keep reading. A CTA at the end encourages inactive subscribers to start a quote and explore their services.

An excerpt of an insurance email from Simply Business

An excerpt of an insurance email from Simply Business

Nelson Policies

Nelson Policies sent a product-focused insurance newsletter highlighting their offerings. The email uses a formal, clean design and focuses purely on informing readers. Subscribers can browse the content and click on buttons to learn more about specific types of insurance.

Jetty

Jetty’s insurance email shares news about its expanded availability across 14 states. The message positions the announcement as a milestone to build customers’ trust in the brand’s growth. It ends by encouraging recipients to share the information with others, adding a community-driven, word-of-mouth element.

Insurify

This insurance email marketing example from Insurify stands out because it doesn’t focus on promoting products or services. Instead, it asks subscribers for feedback to gauge their satisfaction with the company, also known as the Net Promoter Score survey.

It includes a short message, clean visuals, and a simple rating system, making it quick and easy to respond. This customer-first approach fosters trust and demonstrates the company’s commitment to user input.

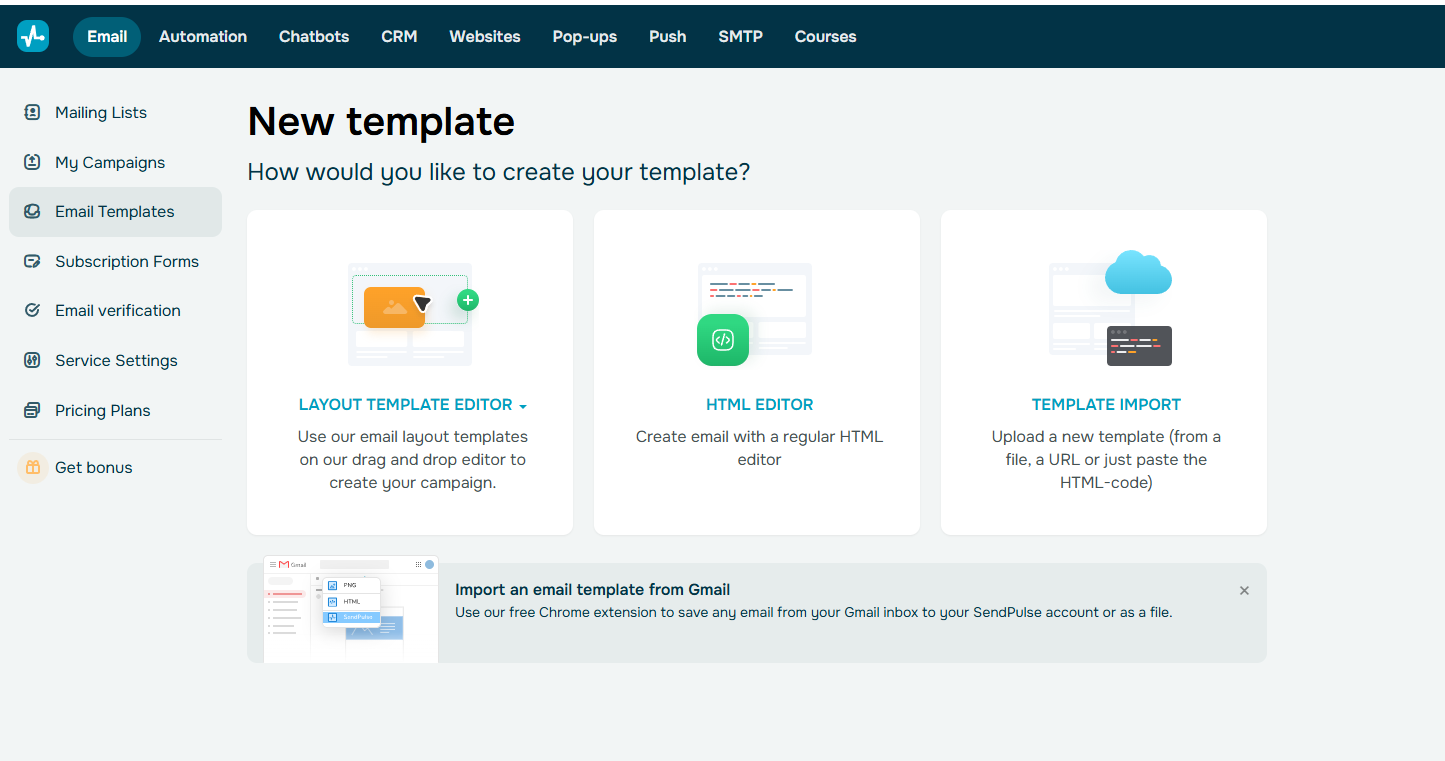

How to create insurance emails in SendPulse

SendPulse offers powerful tools for insurance email marketing, helping you craft effective campaigns with ease. You can import an existing template, use an HTML email editor, or create a template from scratch using its intuitive drag-and-drop email builder.

Creating a new email template in SendPulse

Creating a new email template in SendPulse

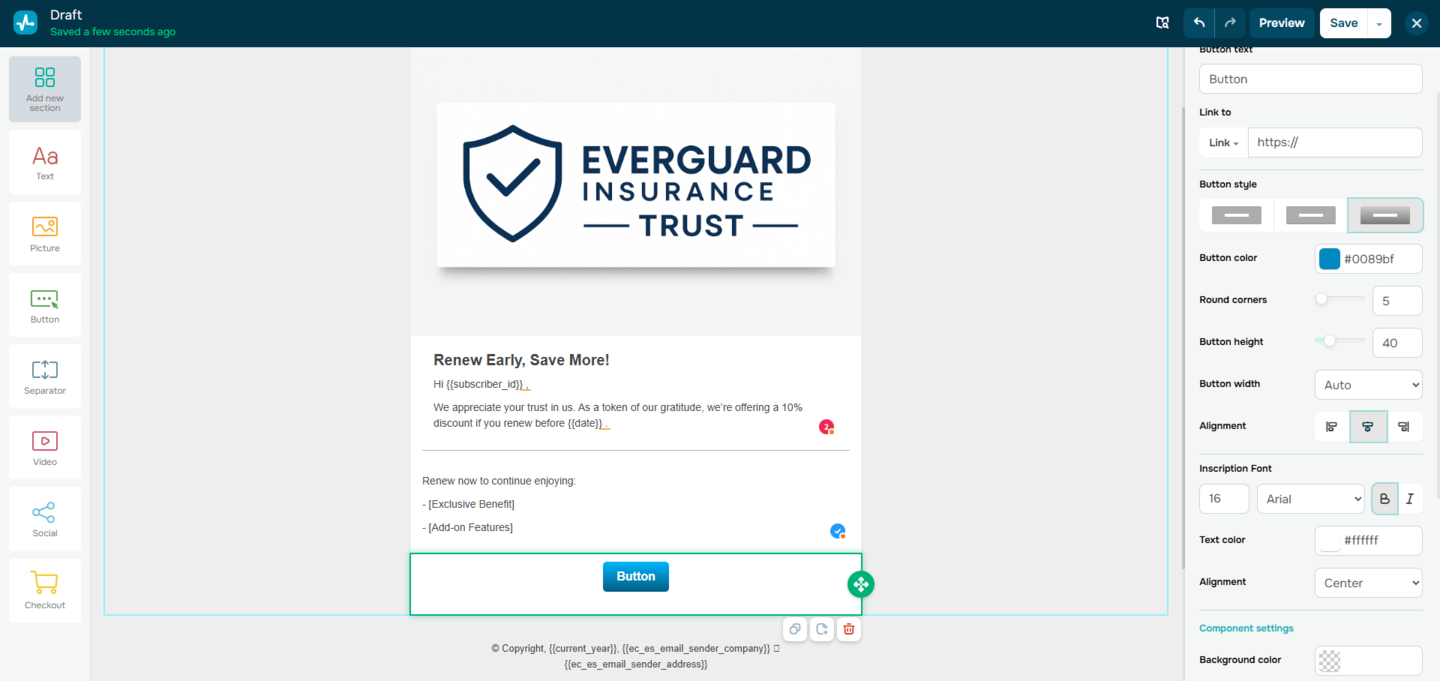

The drag-and-drop email builder makes designing an insurance renewal email template simple. Choose from pre-designed layouts with multiple columns and default elements, or create a fully custom layout. Add images, videos, and other content to personalize your email and make it visually appealing.

For personalization, you can use variables that automatically insert subscriber-specific details. These variables can be either system-generated or custom, ensuring your emails feel more tailored to each recipient.

Creating an insurance email in SendPulse

Creating an insurance email in SendPulse

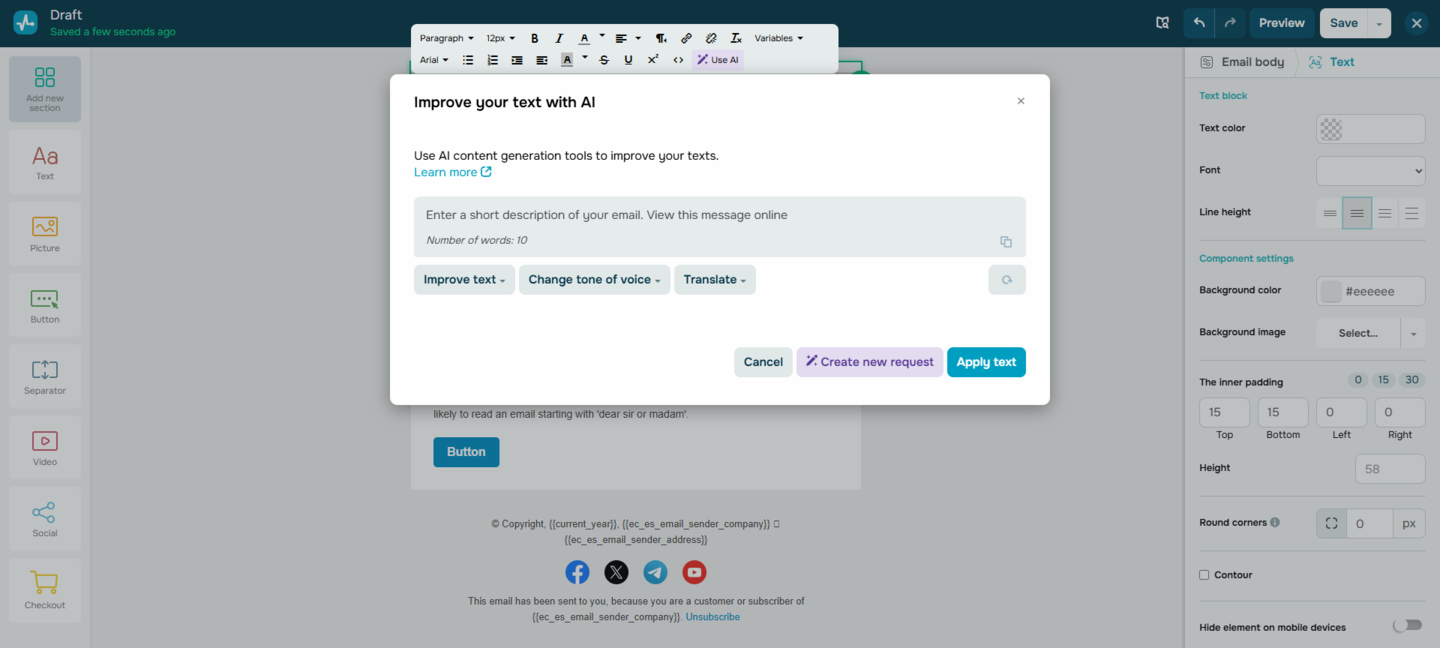

You can also enhance your text with the built-in AI writing assistant. To do this, simply click “Use AI” and choose from options to refine wording, adjust the tone of voice, or translate your email into a different language. If you need entirely new content, simply click “Create new prompt,” enter your request, and the AI will generate it for you.

Using AI to enhance the email copy

Using AI to enhance the email copy

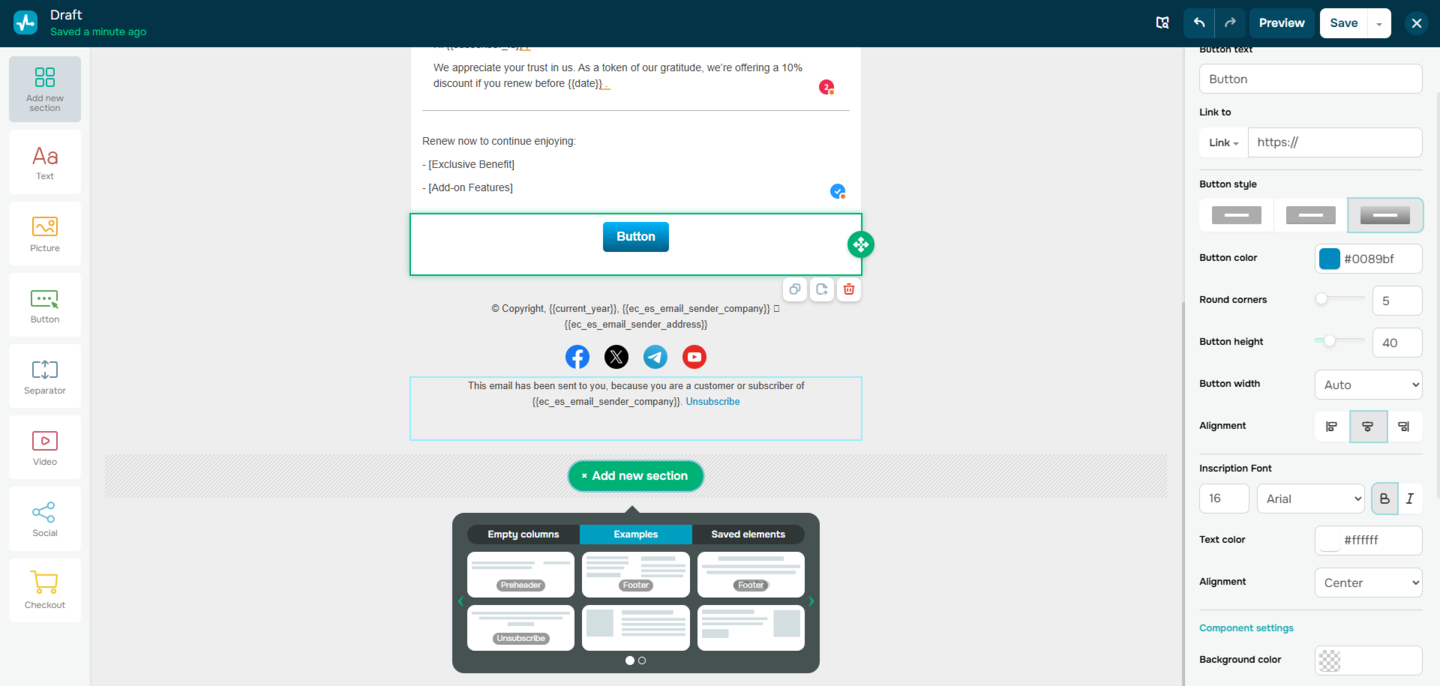

SendPulse offers pre-made sections you can use to quickly build professional-looking emails. These sections are fully customizable, so you can update the text, include your company details, and change the background color of any element.

Adding new sections to an insurance renewal email template

Adding new sections to an insurance renewal email template

All templates built with SendPulse’s email builder are responsive, ensuring they look great on any device. You can also customize the mobile version separately by hiding specific elements to optimize the layout. To preview how your template will appear on both desktop and mobile devices, simply click “Preview” in the top-right corner.

Previewing desktop and mobile versions of an insurance email

Previewing desktop and mobile versions of an insurance email

Before sending your email campaign to subscribers, send a test email to check how it appears in their inboxes. After reviewing, click “Save” to store the template. You can then use this insurance renewal email template for email campaigns, automated workflows, or any other communication needs.

The bottom line

To wrap things up, insurance email marketing is an essential tool for building strong relationships with your customers and growing your business. It offers plenty of opportunities to connect with your audience and keep them engaged.

To truly maximize the impact of your campaigns, selecting the right platform is crucial. With SendPulse, creating professional, eye-catching emails is easy, even without any technical or design skills. It offers powerful features, such as automated campaigns and an integrated CRM system, allowing you to manage your client data in one place. Plus, you can get started for free and upgrade as your needs grow.

Sign up for free now and give it a go!