The prevalence of AI-powered solutions has made even the most cautious consumers consider choosing chatbots over phone conversations — why stay on hold for 40 minutes when you can get your question answered by a smart bot within one minute?

Indeed, chatbots are infiltrating even the most conservative industries, such as healthcare, banking, and insurance. In this post, we want to discuss the benefits of insurance chatbots in particular and how potent they can be in solving clients’ problems or guiding them toward the right department. You’ll also learn how to create your own conversational bot and set it up for success.

Why should insurance companies deploy chatbots?

By 2027, chatbots will become the main customer service channel for at least 25% of businesses. Here’s why embracing and leading change is more than worth it:

- Stay available 24/7. Chatbots can provide round-the-clock support regardless of business hours or time zones. It’s crucial for insurance companies, as their main purpose is to protect individuals in urgent, time-sensitive situations where their health or material well-being is at stake.

- Provide instant responses in emergencies. Chatbots can provide instant responses to customer queries, eliminating the need for customers to wait for an email response. This enhances the overall customer experience and prevents frustration caused by idle waiting and uncertainty.

- Cut costs. Insurance chatbots can handle a large volume of inquiries simultaneously, allowing human agents to focus on more complex issues and let the algorithms handle the rest. This will allow insurance providers to significantly save costs while maintaining customer service quality.

- Preserve customer context. By analyzing customer data and interaction history, AI chatbots can offer personalized insurance recommendations tailored to individual needs and preferences. It helps customers find the most suitable insurance products and enhances cross-selling opportunities for the insurance provider.

- Effortlessly handle requests. Chatbots can assist customers with various tasks, such as filing claims, updating personal information, or obtaining policy information. This streamlines administrative processes and reduces the need for manual intervention, leading to faster resolution times and better efficiency.

- Learn more about your clients. Chatbots can collect valuable customer data, including preferences, behaviors, and pain points. Insurance providers can use this data to understand customer needs, identify trends, and improve their products and services accordingly.

In short, conversational insurance chatbots can handle the lion’s share of customer inquiries without getting exhausted by repetitive questions. They can supply prospective and existing clients with the most up-to-date information and save them hours of research — while freeing up human resources needed for resolving more nuanced issues.

5 common insurance chatbot use cases

When it comes to conversational chatbots for insurance, the possibilities are endless. You can train them on your company’s guidelines and policies and employ them to solve various tasks — here are some examples.

Customer service

Chatbots provide robust customer support automation opportunities. They can handle common customer inquiries, provide assistance with policy-related questions, and guide customers through the insurance application process. Because of their instant replies, consumers can complete their paperwork in less time and from the comfort of their own homes.

Claims processing

Insurance chatbots are useful for assisting customers in filing insurance claims and providing guidance on required documentation and next steps. They can also provide quick status updates on existing claims. Thanks to the bot’s immediate feedback, insurance providers can make the claim-filing process less one-sided and intimidating.

Policy management

Chatbots can help customers manage their insurance policies, such as updating personal information, adjusting coverage levels, or renewing policies. It gives the insured individuals peace of mind and allows them to feel in control of their coverage.

Lead generation and qualification

Insurance providers can use bots to engage website visitors and collect information to generate leads. Insurance chatbots can qualify leads based on predefined criteria and route them to the appropriate sales channels, making sure that every potential client ends up with the best-equipped agent.

Marketing and sales

Chatbots can proactively communicate with potential customers, explain the differences between insurance products, and help them choose the right plan. They can also ask visitors qualifying questions in order to recommend specific products based on their unique needs, leading to increased sales opportunities.

10 best practices for insurance chatbots

It takes a lot of planning and adherence to best practices to maximize your insurance chatbot’s potential. Here are some of them:

- Define your chatbot’s purpose and scope clearly. Determine the specific tasks and inquiries your chatbot will handle to set expectations for users. They need to know what your bot can and cannot do to interact successfully with it.

- Design your insurance chatbot interface to be intuitive and user-friendly. Use clear prompts, buttons, and menus to guide users through interactions. Avoid legalese or lengthy, intimidating descriptions.

- Integrate your chatbot with AI to enable it to process natural language and provide complex, human-like responses. Train your insurance chatbot with real user queries and continuously refine its knowledge of your guidelines to improve accuracy over time.

- Personalize interactions based on user data and preferences to enhance engagement. Use data such as past interactions, browsing history, and demographic information to tailor responses and recommendations.

- Make your chatbot available not only on your website but also across messaging apps that your existing and potential clients use the most. Bots for messaging platforms can help with more spontaneous and time-sensitive inquiries, while your website bot focuses on engaging first-time website visitors.

- Let your customers know that they’re conversing with a bot, but show them that the human agents are always within reach. Be transparent about the chatbot’s capabilities, limitations, and data usage policies to prevent misunderstandings or misuse.

- Implement a seamless handoff process to human agents when your insurance chatbot cannot resolve a user’s inquiry or when a user requests human assistance. Provide context and relevant information to the human agent to ensure a smooth transition.

- Ensure that your chatbot adheres to industry regulations and security standards, particularly when handling sensitive information such as personal and financial data. Implement encryption, authentication, and access controls to protect user data.

- Monitor your chatbot’s performance and gather user feedback to find out what needs to be rectified or reviewed. Regularly update the chatbot’s knowledge base, train it with new data, and address any issues promptly.

- Track key metrics such as user engagement, satisfaction levels, conversion rates, and resolution times to understand how helpful your bot actually is. Use analytics insights to optimize its conversational flows, tone of voice, and scope of expertise.

In short, your virtual assistant represents your company and is responsible for the first impression your brand creates with the newcomers. Because of that, you must ensure that it always acts according to your newest policies, sounds just like your real agents, and provides your clientele with the most relevant information.

5 insurance chatbot examples to learn from

Let’s see how some top insurance providers around the world utilize smart chatbots to seamlessly process customer inquiries and more.

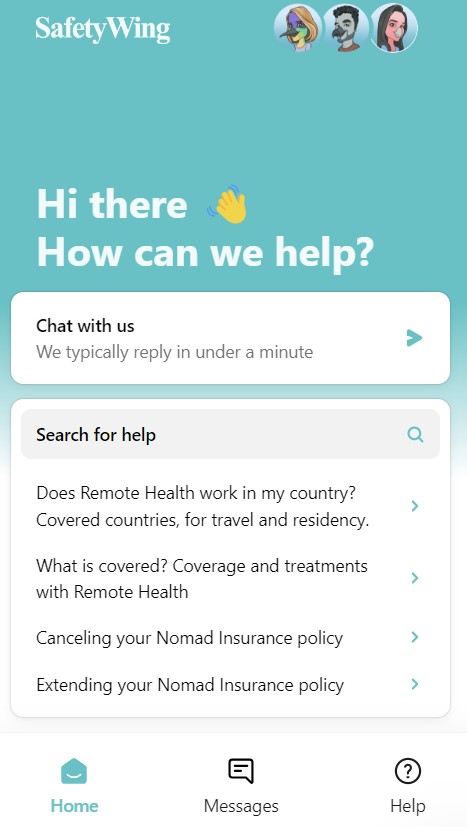

Safety Wing

Safety Wing is a health insurance provider targeting digital nomads and expats, who often struggle to find reliable coverage while hopping countries. The company’s bot is clearly aimed at tech-savvy individuals expecting their insurance policy to be uncomplicated and transparent.

The insurance bot used by Safety Wing

The insurance bot used by Safety Wing

This insurance chatbot example sets a high standard — it features a concise FAQ section along with the approximate wait time and a search bar. Thanks to that, anyone unfamiliar with the concept of nomad health insurance can find answers to their questions in minutes without ever contacting an agent. Nevertheless, there’s also an option to connect with an actual company representative.

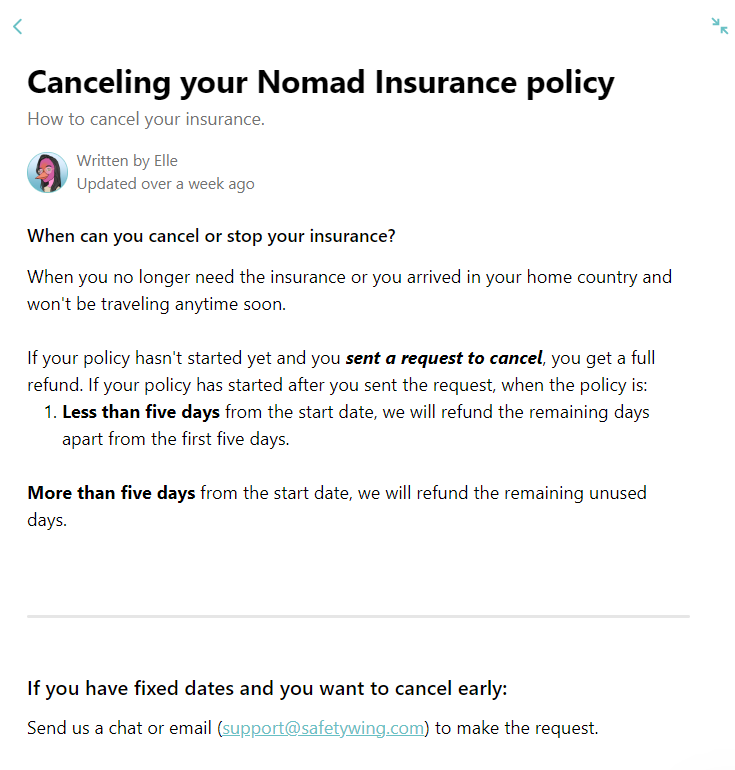

An FAQ article from the Safety Wing insurance chatbot

An FAQ article from the Safety Wing insurance chatbot

Each FAQ link opens a detailed yet easily skimmable article with keywords bolded for better readability. Another fine detail is the “last updated” counter, which gives readers the reassurance that the information they’re shown has been recently reviewed and updated by an expert.

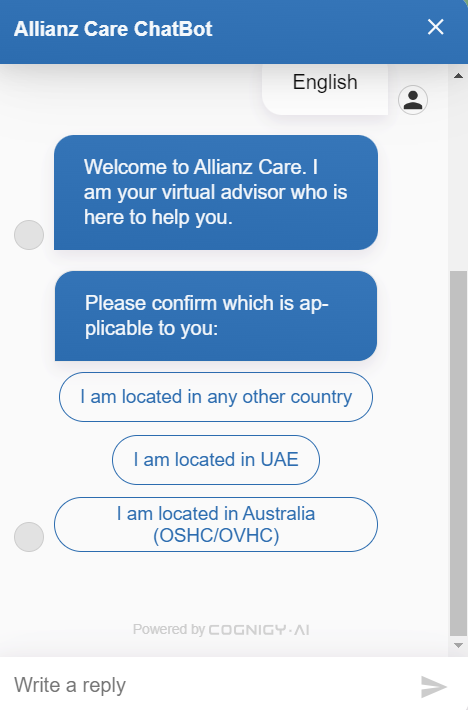

Allianz

Allianz is a multinational financial services company offering, among others, diverse health insurance solutions. Because Allianz has a large international audience, its AI chatbot is required to ask preliminary questions and route visitors based on their location, preferred language, policy data, and other criteria.

The insurance chatbot used by Allianz Care

The insurance chatbot used by Allianz Care

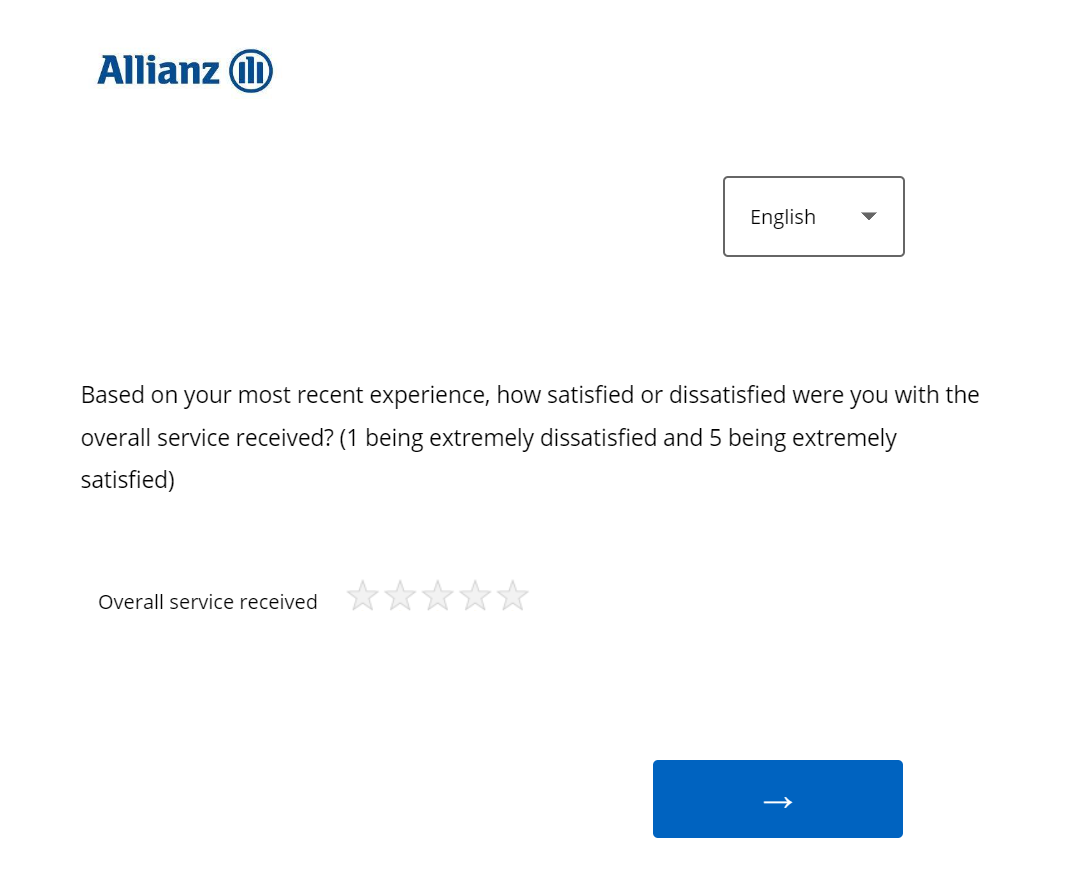

If neither of the criteria applies to the user, they are offered to connect with a human agent. After the interaction, the user is invited to complete a quick survey regarding their chat service experience.

A post-chat survey by Allianz

A post-chat survey by Allianz

This ensures the ongoing improvement of the chatbot and allows the users to share their impressions while they are still fresh.

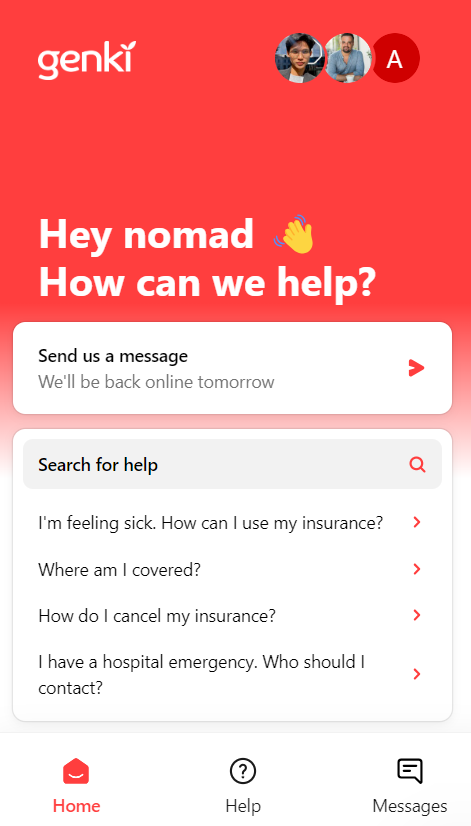

Genki

Genki is a health insurance solution for digital nomads, helping them receive the best care no matter where they are. Genki’s bot has a state-of-the-art FAQ section addressing the most common situations insured individuals find themselves in.

The insurance chatbot used by Genki

The insurance chatbot used by Genki

This insurance chatbot example also comes with a search function and the “current status” update displaying agent availability. Each FAQ question is answered with a foolproof step-by-step guide along with CTA buttons, enabling users to file claims in minutes.

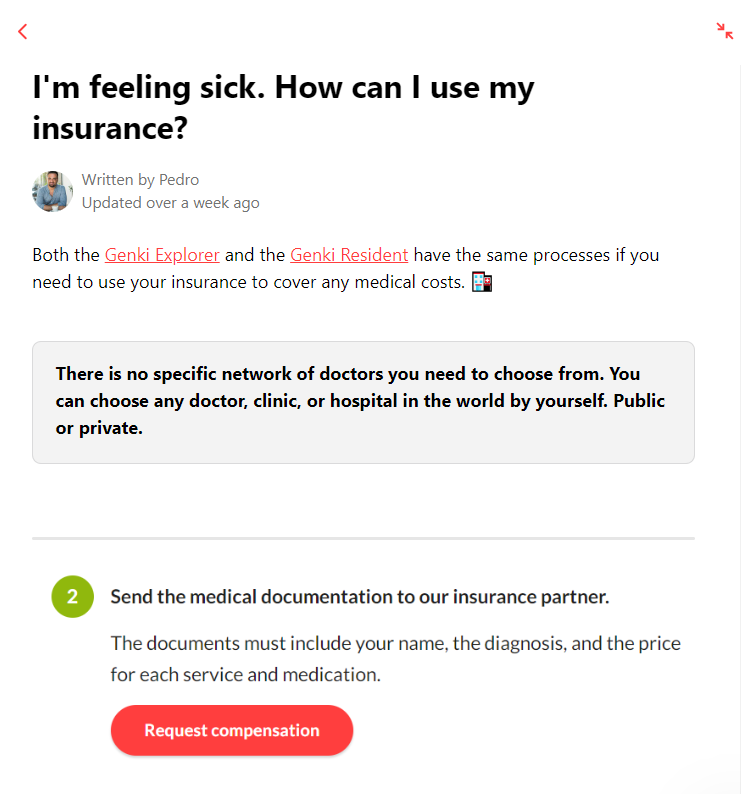

The FAQ section of the Genki chatbot

The FAQ section of the Genki chatbot

Having a customer self-service center within your insurance chatbot is essential as it empowers your customers to instantly get detailed answers in a hands-off manner. The formatting also plays a big role — in this example, numbered points, quotes, links, and highlights enrich the text and make it easier to read.

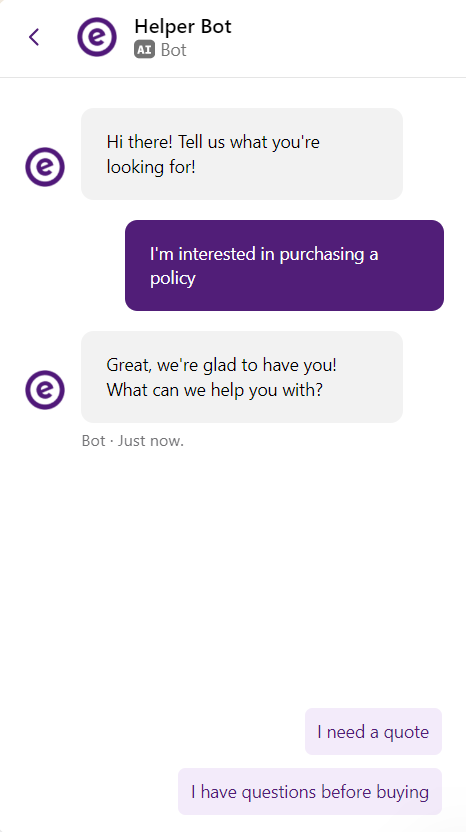

Embrace

Embrace is an American pet insurance provider that aims to relieve pet owners from the burden of unexpected medical bills. The company’s website features an AI chatbot that helps users request quotes, find the right insurance product, place claims, and more.

The insurance chatbot used by Embrace

The insurance chatbot used by Embrace

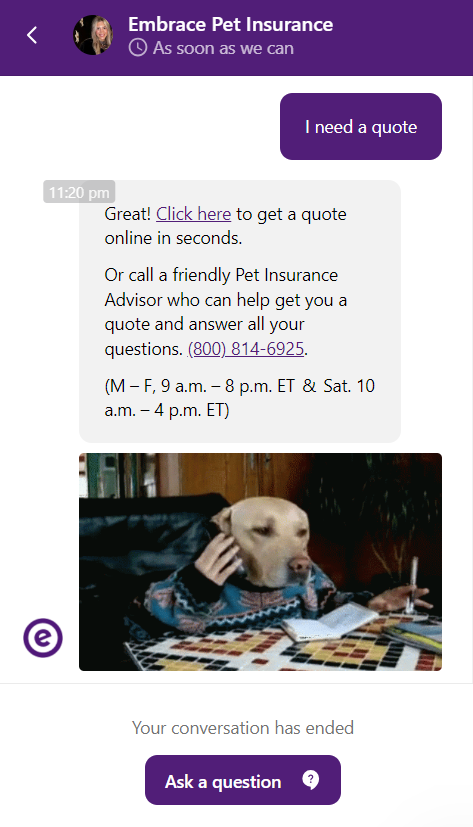

This insurance chatbot is easy to navigate, thanks to the FAQ section, pre-saved quick replies, built-in search, and a self-service knowledge base. Moreover, it has a distinct tone of voice appealing to existing and soon-to-be pet owners — and it’s not shying away from using goofy dog GIFs to make the “boring insurance talk” a bit more lightweight.

The insurance chatbot by Embrace is using GIFs for better engagement

The insurance chatbot by Embrace is using GIFs for better engagement

Last but not least, this chatbot also preserves the message history, allowing users to go back and review the instructions received earlier at any time.

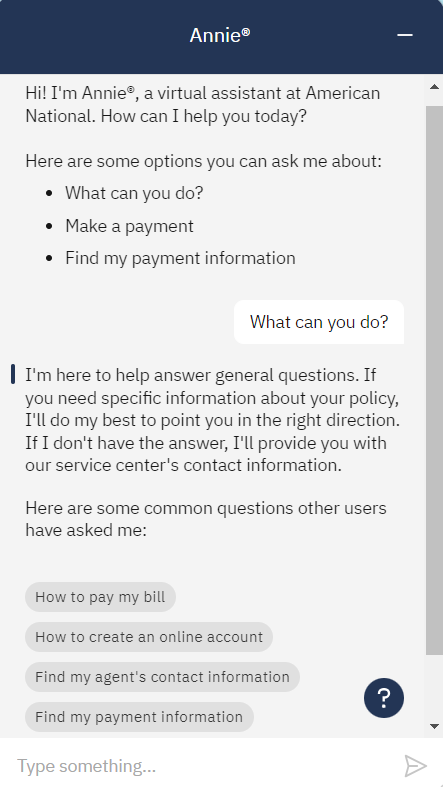

American National Insurance

American National is an insurance corporation offering personalized coverage for life, home, business, and more. The company’s website features a conversational bot ready to help customers navigate American National insurance products and conditions.

The insurance chatbot used by American National

The insurance chatbot used by American National

This insurance chatbot is well-equipped to answer all sorts of general questions and route customers to the right agents in case of a complex issue. It is straightforward and fairly easy to navigate because of the buttons and personalized message suggestions.

How to create your own insurance chatbot with SendPulse

Creating a conversational insurance chatbot with a live chat option is easier than you think, and you don’t necessarily need to know how to code to do that. With SendPulse’s chatbot builder, you can build AI-powered bots for websites, Instagram, WhatsApp, Facebook, and other platforms. Here’s how you can get it done.

Create and connect your insurance chatbot

Log in to your SendPulse account or create a new one. Head to the “Chatbots” tab, then choose “Manage bots.” Choose the target channel for your bot. In our case, it’s a live chat for websites. Copy the site installation code and add it before the closing tag . Then, give your bot a name.

Your live chat widget will combine the capabilities of a bot and a regular live chat, allowing you to answer users’ questions in an automated manner and connect them with agents when needed.

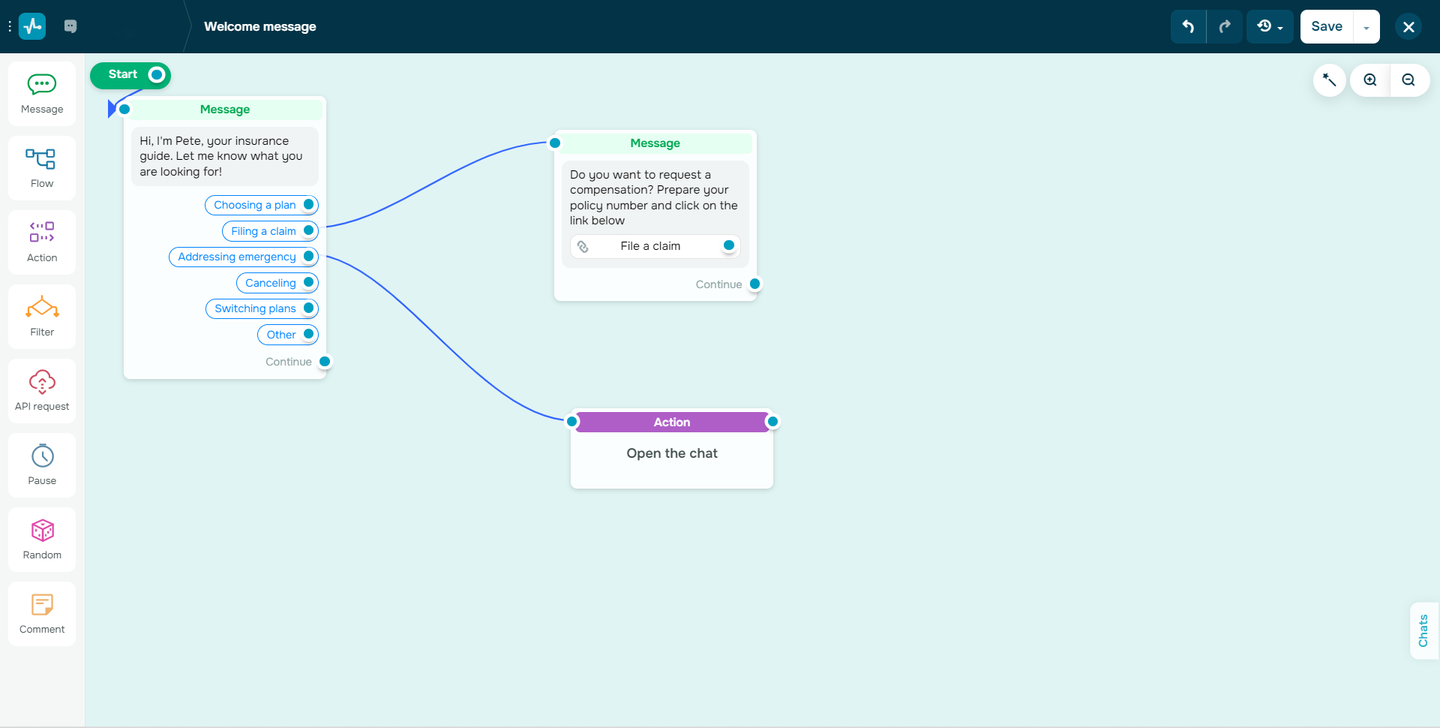

Prepare your welcome flow

Your chatbot welcome message is what your customers will be greeted with. It should describe your bot’s purpose and explain how to navigate it. This is where you can add your FAQ section, buttons, and quick replies.

Creating a welcome flow for an insurance chatbot in SendPulse

Creating a welcome flow for an insurance chatbot in SendPulse

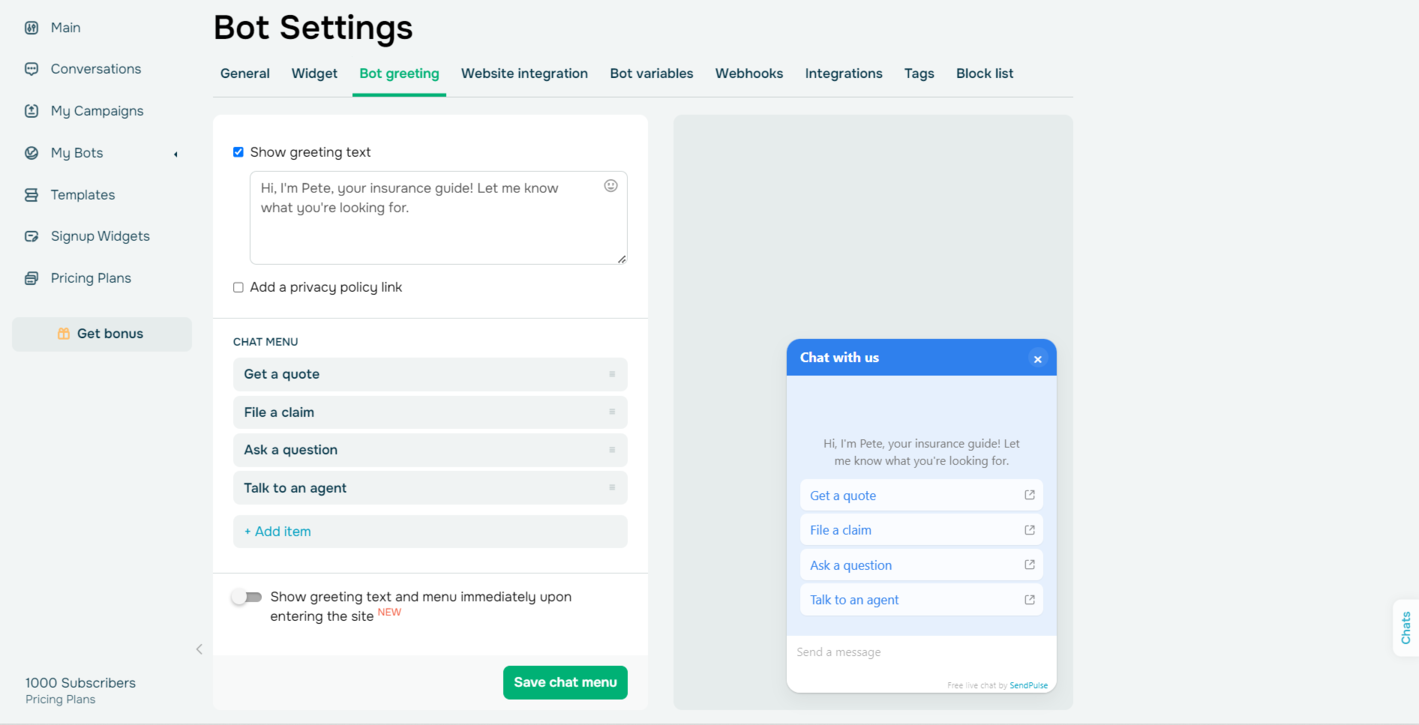

For easier navigation, add menu items to your bot and start certain flows once users click them. Often, it makes sense to add the “Talk to a live agent” option after or when introducing your bot.

Creating a menu for an insurance chatbot in SendPulse

Creating a menu for an insurance chatbot in SendPulse

You can also have your bot offer to chat with an agent if the inquiry is too complex or contains certain keywords. Add any other elements to your bot’s flows by dragging and dropping them from the sidebar to the workspace.

Design your bot’s architecture

Firstly, specify subscribers’ actions and keywords that should start different flows. Then, start building chatbot flows in our visual editor, as shown above. It’s possible to create a flow using AI — simply describe what you want your bot to do. Also, enrich your bot’s messages with images, GIFs, audio recordings, emoji, and other files to add more context. Personalization is possible through variables and tags.

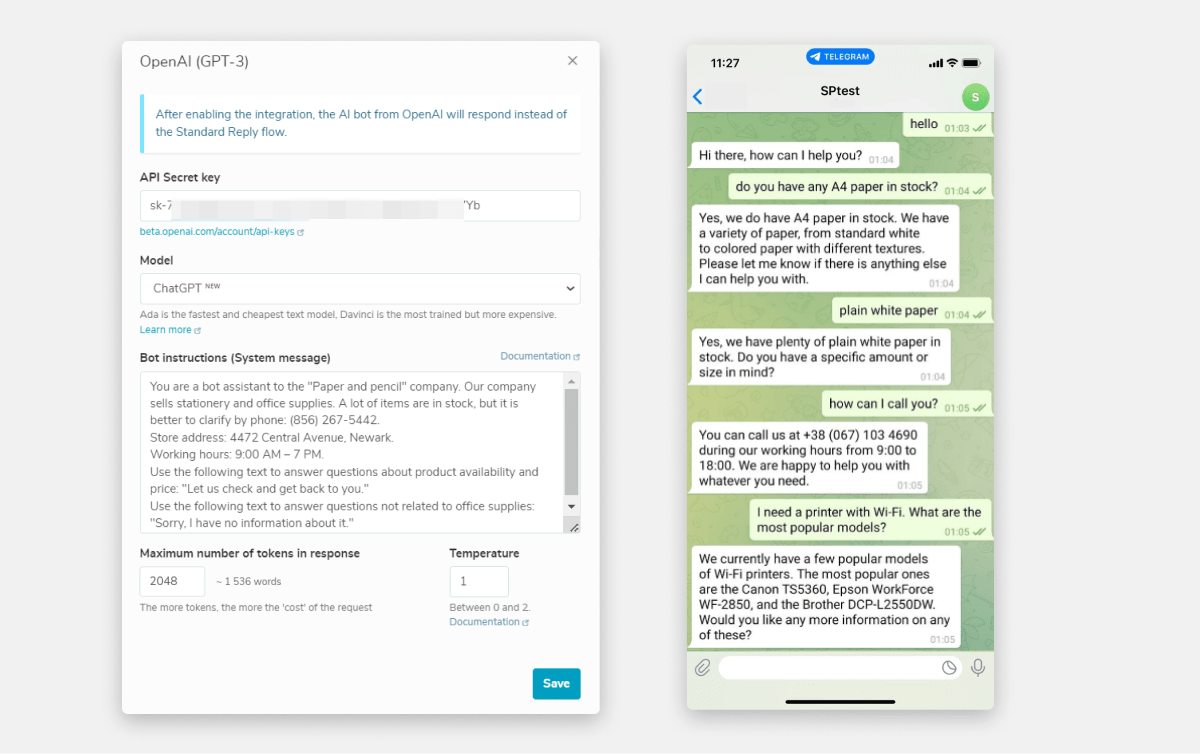

Integrate your bot with ChatGPT (optional)

To make your chatbot mimic a real agent and accurately represent your company, connect ChatGPT to it and train your bot to handle diverse inquiries while strictly sticking to your guidelines. The integration is available with a paid pricing plan.

SendPulse AI bot usage example

SendPulse AI bot usage example

For this to work, you need to choose an AI model and add prompts to introduce limitations. Feed your bot information about your company and insurance products, adding as much context as possible.

Find out more about

best AI chatbots for marketing, support, sales, content production, coding, and more.

When you integrate with ChatGPT, it will take over your “Standard reply” flow. However, you’ll still need to monitor your bot’s conversations, as AI bots only have short-term memory and may need occasional human input.

Wrapping up

Creating chatbots is a budget-friendly endeavor, even if you are running a small business and your funds are tight. Our pricing plans start at $10 monthly for 500 subscribers and unlimited chatbots and live chats. You can also try our chatbot builder for free — send up to 10,000 messages across all your bots every month!