Gross profit is a profit that remains after deducting the production costs. It helps evaluate how efficiently a business uses its labor and supplies in the process of manufacturing and get to know the financial performance of a company.

Why is it important to measure your gross profit?

The measure indicates the revenue a company brings to its owner after calculating the investments in producing and selling products or offering services. It helps evaluate the profitability of a specific company and monitor its financial performance. Besides, it demonstrates the sufficiency of a company in terms of using labor and raw materials.

A decrease in gross profit during a certain period helps identify the reasons for this process so that a company can take action to resolve the problem. Indicators that influence gross profit include:

- changes in the products;

- the efficiency of company management;

- changes in accounting policies;

- the cost of purchasing raw materials;

- the number of employees;

- the level of competitiveness of products and services;

- sales volume.

If you want to calculate your company's gross profit, you need to subtract the costs for manufacturing and selling products. These are variable costs, including costs for direct labor, raw materials, shipping, packaging, etc. Afterward, your company can determine whether the business brings revenue.

Now let's make the difference between the two main types of profit clear.

Gross Profit vs. Net Profit

Profit is the money your firm generates. It shows you how efficiently and successfully your company operates by comparing current revenues with the previous ones. If you aim to track your firm's financial performance, you need to be ready to distinguish the two main types of profits.

Knowing the difference is essential for investors because gross and net profit help determine whether a certain company obtains revenue. In case it doesn't earn, these parameters also enable investors to figure out where the firm loses money.

- Gross profit. It is money a company obtains after deducting the costs related to the investments in production and selling the goods and services. It tells you how effectively you use labor and raw materials to produce goods. With the help of this measure, you can evaluate the financial performance of your business. After figuring this out, you can decide whether to cut down the expenses on manufacturing and selling the products or charge a higher price for your goods if the business doesn't perform well.

- Net profit. If you want to evaluate your net profit, you need to estimate gross profit first and then deduct all operating and interest costs as well as tax expenses over a certain time. This measure helps you monitor the financial health of your firm. Net profit also determines when to expand your business or reduce expenses. If you own a company, you need to calculate net profit because it helps creditors be aware of the state of your business and the cash available. Entrepreneurs would also refer to this parameter when considering investing in your firm.

You have to estimate the values of the two parameters to create an income statement, demonstrating your revenue and expenditures. Knowing the peculiarities of these two types of profit enables you to see a realistic picture of your business. To calculate them correctly, you need to have the necessary formula, so let's dive in.

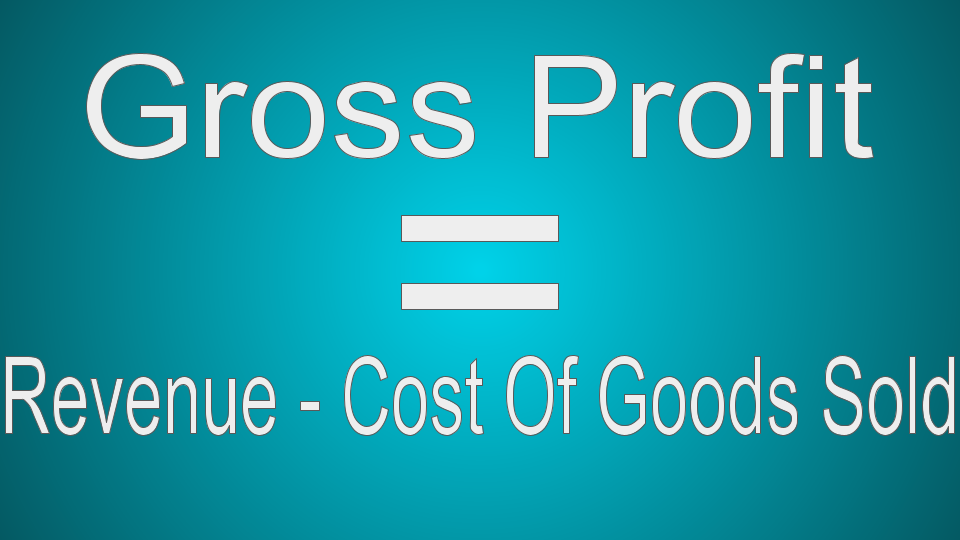

How to Calculate Gross Profit

One of the essential things you need to know when running a business is how to measure your company's gross profit. This metric focuses on variable costs (alter with the change in output), including direct labor, credit card fees, materials, and shipping. The measure excludes fixed costs, such as property taxes, insurance, rent, and advertising.

Below you can see a formula that helps you estimate the metric easily. You need to subtract the sum of money spent to produce and sell products from the revenue you managed to obtain to calculate this measure.

Gross Profit Example

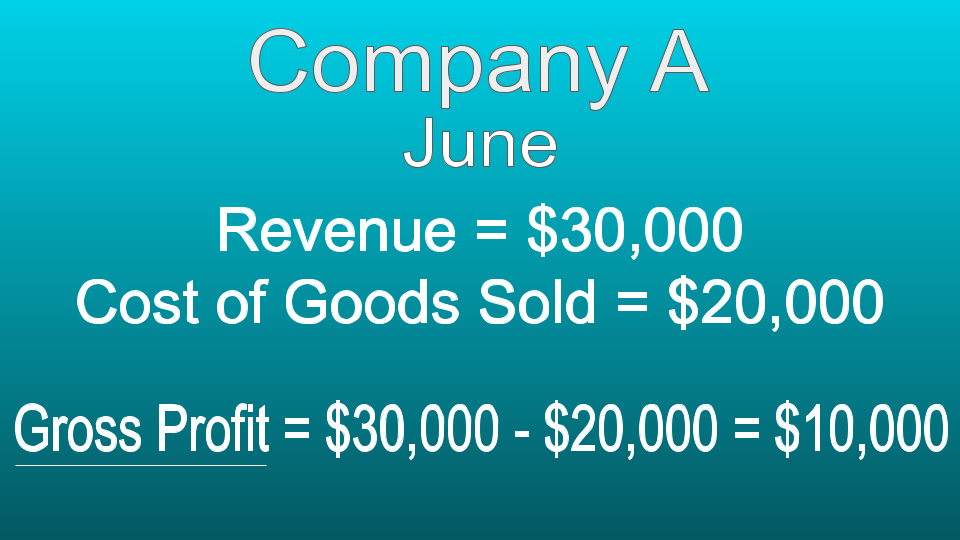

Now it's time to practice how to estimate gross profit with the help of the example below. Further, we'll compare the gross profits of two competing businesses. Let's imagine that we have two companies that manufacture and sell toys for children.

Say, company A obtained its $30,000 revenue in June. The firm spent $20,000 on the manufacturing and selling process to get such a profit.

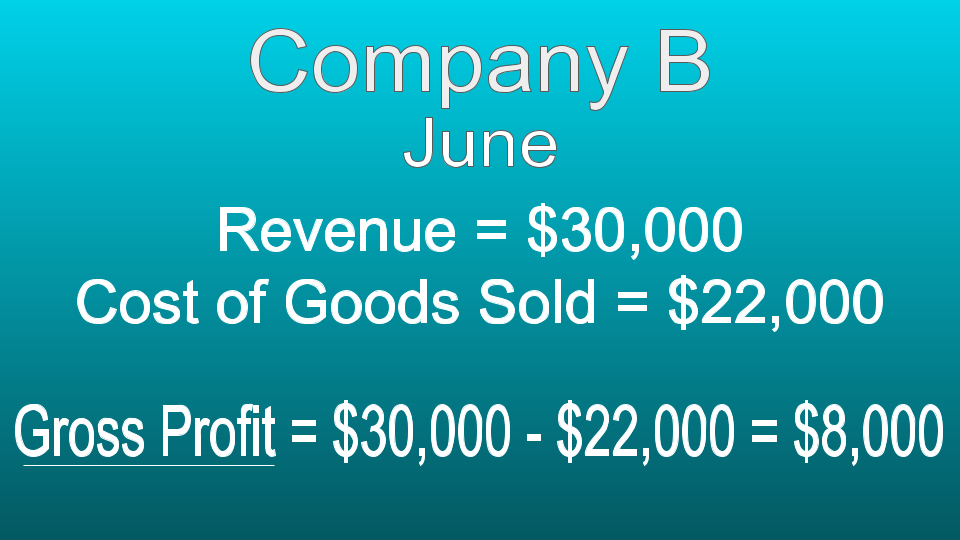

Now it's time to proceed to company B, which also obtained its $30,000 revenue in June, and this firm spent $22,000 to produce and sell the same amount of products. Let's now estimate the gross profit of company B.

The calculations above demonstrate that company A has $2,000 more in gross profit. It shows that they use their funds more efficiently to produce the same amount of toys for children in the same time frame.

It's essential to know how to increase your gross profit, and that's why we'll offer several tips.

5 Tips to Increase Your Gross Profit

- Increase your selling price

- Boost sales

- Reduce the cost of products your company sells

- Remove products that don't bring profit

- Get more customers

- Increase your selling price. Consider increasing the price of your products or services. However, ensure that the cost of such goods is the same. Increasing the price allows you to obtain higher revenue and, as a result, a higher gross profit. You should remember that if you charge your customers a price that is too high, you can face the risk of losing them.

- Boost sales. Consider implementing different strategies to increase your sales. For this purpose, you can enhance your sales channels and use social media platforms and messengers to offer your products and services. With SendPulse, you can use chatbots, email campaigns, and landing pages to sell your goods. Besides, think about promoting your products on various platforms by describing their benefits and the issues they can solve. Make sure that your customer service helps your existing and potential clients with their problems.

- Reduce the cost of products your company sells. If you can find a way to cut down the cost of goods sold, you will be able to increase your gross profit. You can find suppliers that offer lower prices and use cheaper raw materials or labor-saving technology to implement this technique. However, ensure that it won't influence the quality of your goods because customers can choose your competitors to obtain products of better quality.

- Remove products that don't bring profit. First of all, you need to identify the products or services that allow your business to benefit and bring good revenue. Pay attention to these certain goods to make the profit even bigger. Secondly, find out which of the goods don't bring you any benefit to learn about the improvements that should be made or consider removing these products.

- Get more customers. You can reach your potential customers in several ways, such as email marketing, video marketing, social media, blog posts, etc. With email marketing, you can convert your leads into customers. SendPulse allows you to send out a newsletter that includes engaging content about your products. This enables your prospects to discover more about your company and purchase from your brand.

Now you know that gross profit is an essential parameter for any business. If you want to determine whether your company uses resources efficiently and brings you revenue, it would be useful to calculate the measure.

Resources:

- This article defines the term, explains how to calculate gross profit, and provides an example.

- In this article, a reader can learn how to calculate gross profit.

or