An average fixed cost (AFC) defines how much it costs to manufacture one unit. It helps measure the breakeven point of a certain company, analyze the expenses of a business and reduce them to make it more beneficial.

Why is calculating an average fixed cost important?

Different brands sell their goods or services at a fixed price. Entrepreneurs have to be aware of the number of funds spent on production and estimate a profit margin by using fixed and variable costs formulas to set those prices. Companies use the AFC formula for several reasons:

- analyze their expenses to find ways to reduce them and make their business bring more revenue;

- measure the breakeven point (the point at which a company starts to generate profit).

Investors and entrepreneurs can’t understand the whole picture of their company’s performance just by looking at the costs. If you aim to know, for example, how a particular business operates, you need to look at the relation between the fixed costs and the number of manufactured goods. You need to divide these two measures to obtain the average fixed cost. This will help you define the efficiency of production and the economies of scale (financial benefits your company can reap).

Salaries of permanent workers and payments for plants and equipment are examples of fixed costs. Companies can’t operate without paying for equipment and appropriate building. Besides, you should define the number of units your company needs to produce by yourself.

Hence, with the help of AFC, you can find out the number of funds you should allocate to produce one unit. Let’s find out how to estimate this metric.

How to Calculate an Average Fixed Cost

You can use two different methods to estimate an average fixed cost for a business. Further, we’ll discuss each of them in more detail.

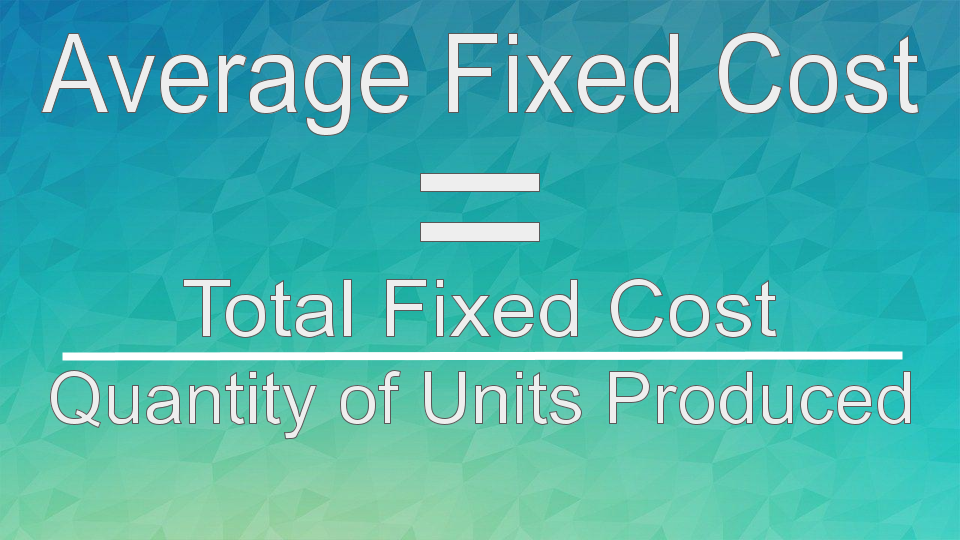

In case you want to define how total fixed costs influence the fixed costs per unit, it’s advisable to use the division method. Firstly, you need to determine the time frame since fixed costs are estimated over a set period. It enables you to figure out when you’ll start breaking even and obtaining a profit.

Secondly, add all the fixed costs (costs that remain the same even when the number of manufactured units changes). Thirdly, get the total number of goods produced during a certain period. Finally, after adding all the fixed costs and obtaining a total fixed cost, you should divide it by the number of products manufactured by your company during this specific period.

Below you can see the AFC formula.

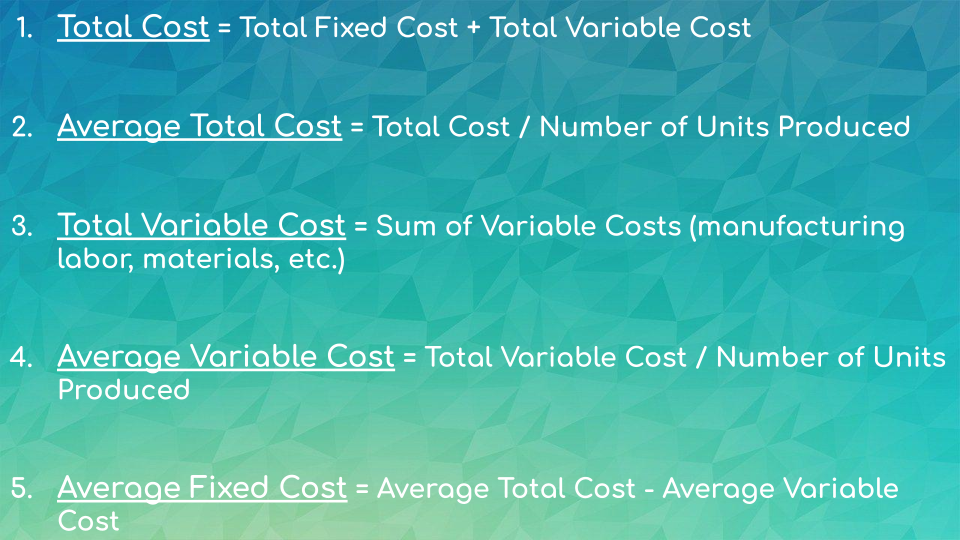

When you use a subtraction method, the first thing you should do is estimate the total cost. Afterward, you need to determine two indicators: average total cost and average variable cost. The final step in this method is to subtract the average variable cost from the average total cost.

Below you can see the necessary formulas to estimate these measures.

If you need these calculations, choose the method that suits you the most. Now let’s proceed to the differences between average fixed and average variable cost.

Average Fixed Cost vs. Average Variable Cost

Average fixed cost is the cost required to manufacture one unit of products. This cost decreases as the number of goods produced increases. This is because the same amount of fixed costs needs to be spent to produce a larger number of units. You can calculate the cost this way: divide the sum of all fixed costs by the number of manufactured units.

By calculating this measure, you have an opportunity to analyze your firm’s expenses and to reduce them, and identify the point where your business begins to generate revenue. The cost helps you obtain the information necessary for your production decisions. If you want to maximize your revenue, it’s critical to control this cost. You should know how it alters when there’s a change in the quantity.

Average variable cost (AVC) is a sum of all variable costs divided by the number of goods produced. It is a critical factor that helps a company decide whether it’s worth continuing the production of its goods. A company can continue only if the marginal revenue is bigger than the AVC.

If the average revenue of a company is lower than the AVC, it would be better to shut down this business. Since manufacturing anything wouldn’t help obtain a profit big enough to offset the variable costs of production, minimal production would also add losses to this firm. Therefore, it is better to stop operating and lose only the fixed costs.

On the other hand, when a business obtains costs bigger than the AVC, it can cover some of the expenses, including all the variable costs and some of the fixed costs. Fixed costs, like the money you pay to rent a space for your business, aren’t influenced by production. For sure, they don’t alter when the number of units you decide to produce changes. As long as your revenue is higher than the AVC, you can continue to produce your goods.

Let’s move to the next part to review several examples and understand how to estimate this measure accurately.

Average Fixed Cost Examples

Let’s imagine that there is a company engaged in the cultivation of coffee. The firm’s team has hired five permanent employees and has to pay $5,000 per annum to each worker. Besides, they have to pay for the necessary equipment $70,000 per annum. They also spend $15,000 to rent a building to store coffee. The company’s total output is 1000 tons. Let’s estimate their average fixed cost.

The coffee company’s total fixed cost will be $110,000 ($5,000*5 = $25,000 for labor, $70,000 on equipment, and $15,000 to rent a building).

AFC = $110,000 / 1000 = $ 110 per ton.

Therefore, with the help of this formula, we were able to calculate the AFC for this coffee company.

Let’s look at another example, a company that manufactures sneakers. If the quantity of the output varies from 7 to 12 pairs of running shoes, the fixed cost would be $49. To estimate the AFC, you need to divide $49 by 7 sneakers. It would be 7. Simply put, to manufacture 7 pairs of sneakers, you need to spend $49 (fixed cost) and obtain a pair of shoes that would cost $7.

To sum it up, AFC enables entrepreneurs or investors to determine the number of funds necessary to produce one unit of products. It helps them define the breakeven point of a business.

Resources:

- This article defines the term and explains how to calculate average fixed cost by using two methods.

- In this article, you can find the formula and examples.

or