To earn some money, one first has to spend money. Moreover, it should be spent wisely and allocated with precision. In this article, we will shed some light on customer acquisition cost: why this metric is important for business and how do you calculate CAC, use, and decrease it without any loss on effectiveness.

What is customer acquisition cost?

Customer acquisition cost is the money a company spends to attract a profitable customer. As a rule, this metric is abbreviated to CAC.

However, make sure you do not mistake CAC for CPL (cost per lead), a similar metric denoting a request for a callback, at a phone number or an email address a potential customer has provided. In other words, it’s just any step a lead makes towards the bottom of the sales funnel. However, a lead won’t necessarily become a customer and generate profit.

What is a good customer acquisition cost?

To understand whether you can afford your current CAC, you need to calculate your customer lifetime value (LTV), which is the profit generated for the company from an average customer.

A business is considered profitable if the customer’s lifetime value is three times higher than the customer acquisition cost. If the gap is smaller, consider reviewing your strategy and reducing costs, as you may not be generating any profit at all or even staying in the red.

Why calculate CAC anyway?

Let’s try to calculate CAC using this basic formula: divide the cost of the promotional campaign by the number of clients generated as a result of it.

For example, a Facebook ad campaign that costs $50 has brought you five new orders. This means that each new client has cost you $10. At the same time, a sponsored link in Google cost $100 and generated seven new orders. In this case, the CAC makes approximately $14.

This basic customer acquisition cost formula does not take into account various additional costs. However, the main point is clear: by calculating CAC, you can understand which marketing channel brings you customers at the lowest cost and determine the profitability of your business.

Note! Make sure to calculate not only the CAC but also the LTV for each channel. Some platforms will generate more profitable customers in the long run despite the high initial CAC.

How to calculate CAC

As usual, there are two ways: the first is easier while the other is more complex. We have already demonstrated the ‘easy’ approach: it will come in handy if your company is comparatively small and approximate calculations will do. However, if you plan to use the figures for further analysis and strategizing, it’s better to take some time and use the more detailed customer acquisition cost formula.

Before you start, determine who you consider your customer. For example, should you take into account users who bought a trial period of your program for $3 or will you consider them leads rather than customers? There is no definite answer; you should determine for yourself which of the customers’ actions will amount to a purchase.

Note! If you have customers who do not pay for services, for example, they are using a free plan, do not count them while calculating CAC.

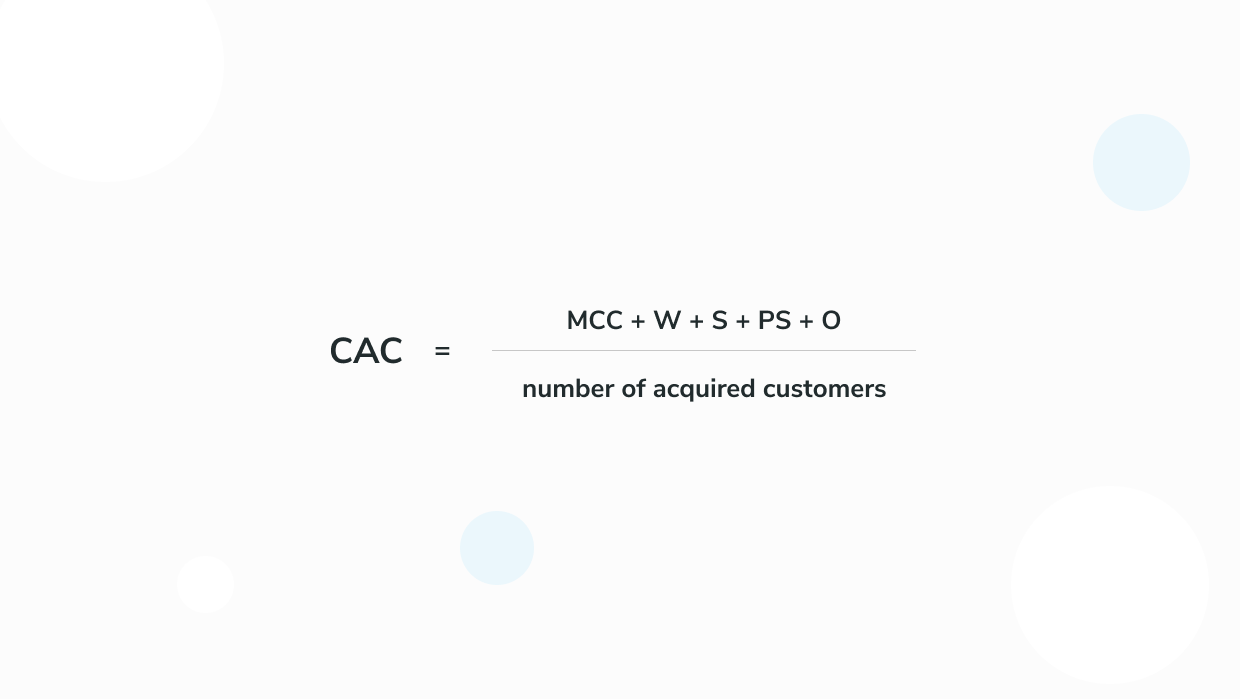

Here’s what a detailed calculation of the cost of attracting one customer looks like:

Customer acquisition cost formula

Customer acquisition cost formula

The calculation requires the following data:

- MCC (marketing campaign costs) — the total amount of money spent on marketing campaigns aimed at attracting new customers;

- W (wages) — the wages of marketing specialists and sales managers;

- S (software) — the cost of software like CRM, website development and support, analytics services, and others;

- PS (professional services) — the cost of any additional services outsourced to specialists outside the company, for example, design, analytics, creation of photo and video content;

- O (other overheads) — other expenditures.

In addition, always take time into account. In some industries, it can take up to a few months for a customer to make a purchase decision: one can spend a long time choosing a car or expensive software for their company. In this case, the CAC will start to pay off only in a few months, and this should be factored in the calculation. At the same time, you need to consider seasonality, so you’d better calculate CAC for the entire year.

How to decrease CAC

One can and should make customer acquisition less costly. Even though your business may be profitable enough, always look for ways to curb expenditures. Let’s see some of the methods that will help you lower your CAC without losing effectiveness.

Search for new marketing channels

Contextual advertising, social networks, banners on partner websites, native advertising, viral videos — use all of the methods available nowadays. Try email marketing, it will help decrease your CAC, especially at the very dawn of your business:

- Wages and overheads. With SendPulse, you don’t need an email designer or an analyst. There are a number of ready-made templates that can be easily fine-tuned in the drag and drop editor to suit your needs. If none of the templates suit you, create your own, it’s a very simple task. The service also provides email marketing campaign statistics, can be integrated with Google Analytics and allows you to conduct A/B testing before mailing.

- Software. Use our free plan: store a mailing list of up to 500 contacts and send up to 15,000 emails a month.

Having calculated CAC for each channel, do not narrow down your strategy to one or two of the most profitable ones. Keep in mind that parallel promotion enhances the effect: for instance, email marketing and social media can work together.

Analyze the buyer behavior

Use behavioral marketing tactics to build a series of events that will guide your prospects towards a purchase decision. Analyze weaknesses: customers may be leaving due to poor UX or a complex buying process, or they may simply lack information about the product. By analyzing the buying behavior, you can not only optimize the buying process but also identify the most profitable customers with potentially high LTV.

Points to remember

The customer acquisition cost (CAC) is the money spent to attract one customer that eventually brings profit to the company. Don’t confuse CAC and CPL (cost per lead). Getting a new lead is only one step towards closing a deal, it does not guarantee any profit.

CAC is calculated to identify the most profitable channels of customer acquisition — those that bring in customers at a minimal cost.

A good CAC should not exceed a third of a customer lifetime value (LTV), that is, all the profits generated as a result of the cooperation with the client. If CAC is higher than one-third of a customer LTV, then the company is likely to stagnate or even lose profitability.

To calculate CAC, you need to add up all your marketing costs and divide them by the number of customers you have. In this case, customers are clients who bring the company money: for example, they bought the product instead of just subscribing to the free trial version.

Marketing expenditures include

- money spent on all promotional campaigns;

- wages of marketing and sales specialists;

- software (the website and all other services used);

- the cost of all outsourced procedures;

- all other expenditures related to marketing.

You can lower your CAC without losing the effectiveness of your business. In this case, you need to

- search for new promotion channels and combine them for better outcomes;

- analyze buyer behavior and adjust the sales funnel according to it.

Constantly analyze your work, this is essential, even for small companies. Sign up for free services, such as SendPulse, to do email marketing for free. You can always try to optimize your business processes and allocate the saved resources more effectively for business development.