Imagine that you are on a long-awaited vacation, enjoying exotic cuisine and soaking up the sun. It’s late evening, and you’re about to check into the new hotel. Suddenly, the receptionist approaches you with a concerned face and tells you that your card has been declined. They run it through again — still nothing.

Apparently, your bank froze your card for suspected illegal activity. There are no ATMs around, and your wallet has only ten-dollar bills in it. The perspective of sleeping outside is becoming more real with each minute. What do you do?

Not so long ago, your only option would have been to call your bank and desperately wait on hold for hours because of the time difference. Now, many banks offer convenient 24/7 bots, which can help clear up customers’ problems in seconds. That’s the magic of banking chatbots — read on to learn more about this powerful tool for fintech and beyond.

What are the benefits of chatbots in banking?

Modern AI-powered banking chatbots can be compared to personal assistants on steroids. They greet customers at the virtual door, provide 24/7 guidance, and connect them with appropriate agents should their issue require human attention. Here are a few reasons to consider employing a virtual bot:

- Speed and convenience. With chatbots, customers can get quick answers to their burning banking questions without waiting on hold or navigating through a maze of automated menus. The chat widget is typically placed prominently on the bank’s website and remains right at visitors’ fingertips.

- The power of artificial intelligence. Today’s virtual banking assistants can understand natural language and learn from each interaction. It allows them to handle more complex inquiries and provide personalized recommendations based on the user’s needs and goals. They’re always up-to-date with the latest banking products and features, so you can trust that your visitors get accurate information every time.

- Human-like interactions. Despite being powered by AI, chatbots are surprisingly good at mimicking human conversation. They can crack jokes, express empathy, and help the bank feel less like a soulless corporation and more like an entity with a human face and a team of caring and responsive experts behind it.

- Accessibility. Traditional banking services aren’t exactly user-friendly. With conversational AI chatbots for banking, anyone can navigate complex financial products and stay on top of their digital wallet. These chatbots often support multiple languages and have an intuitive design with quick replies and FAQs.

- Transparency. All interactions with a banking chatbot are easy to trace and review, allowing customers to go back to their chat history at any moment and verify the information the bot gave them.

Even better, practically any kind of financial service or banking product can be paired with an intelligent chatbot — and you’re about to see why.

Potential use cases for chatbots in banking

When employed correctly, chatbots in banking can dramatically enhance customer service, streamline operations, drive engagement, and more. Below is a quick overview of their capabilities.

Use case for chatbots in banking #1. Multilingual customer support and queries

AI chatbots usually can answer frequently asked questions in multiple languages, reducing the burden on human customer service agents and enabling round-the-clock support. It’s also possible to equip them with a concise self-service help center where customers can access longer how-tos and articles.

Use case for chatbots in banking #2. Account management

Chatbots are perfect for helping users manage their accounts on the go and make sense of certain terms, options, plans, or conditions. This simplifies banking processes and allows customers to always feel in control of their funds and assets.

Use case for chatbots in banking #3. Financial advice and guidance

When trained properly, AI chatbots can offer personalized financial advice based on user preferences, spending patterns, and financial goals. They can provide recommendations for saving strategies, investment opportunities, debt management, and budget planning as well as offer related banking products and tools.

Use case for chatbots in banking #4. Product recommendations and upselling

Chatbots can analyze user data to recommend relevant banking products and services, such as credit cards, loans, savings accounts, or investment options. Through targeted messaging and personalized offers, chatbots can gently push customers toward exploring account upgrades, building their investment portfolio, and more.

Use case for chatbots in banking #5. Managing lost and compromised cards

Chatbots are useful for guiding customers through the process of reporting and blocking a lost or stolen card. They can ask the necessary questions, gather relevant information, and ensure that the report is complete and accurate. And, once a card is reported lost or compromised, chatbots can initiate the process of issuing a replacement card. In addition, their instant, human-like responses are likely to provide solace and comfort to users genuinely worried about the safety of their funds.

Use case for chatbots in banking #6. Onboarding and account opening

When it comes to the account opening process, chatbots can guide the user through the necessary steps. They are useful for collecting information, helping customers prepare for identity verification, and assisting with documentation submission. This reduces friction for new account holders and makes the banking products more available to diverse target groups.

Use case for chatbots in banking #7. Loan application and general creditworthiness assessment

Chatbots are also perfect for facilitating the loan application process — they can gather applicant information, assess eligibility criteria, and guide users through required documentation submission. This way, the user can quickly find out how likely the new loan is to get approved without having to do the full-scale paperwork.

Use case for chatbots in banking #8. Presenting new banking app features and updates

Another chatbots’ strong point is their ability to announce and break down any upcoming changes regarding the bank itself, its app, policies, and so on. Depending on the bot widget, it may be possible to make the chatbot send bulk campaigns, pin the announcement at the top of the chat window, or use it to notify individual users. In any case, customers can always stay in the loop, learning about the new features in a natural conversational manner.

Use case for chatbots in banking #9. Customer satisfaction measurement

Chatbots can ask customers for feedback through interactive surveys and feedback forms, gauging satisfaction levels, identifying areas for improvement, and collecting valuable insights for product development and service enhancement. Because the assessment happens directly in the chat, there’s less friction, and, as a result, the user is more likely to share their impressions.

Use case for chatbots in banking #10. Fraud prevention and customer education

Through chatbots, banks can help their customers avoid becoming victims of financial scams or identity theft. Because the bots are available 24/7, users can quickly check in with them to make sure that whoever is asking them for their social security number is not associated with their bank. Alternatively, the bot can proactively share the latest tips on how to avoid credit card fraud and keep one’s finances secure.

What to pay attention to when creating chatbots for banks?

When creating your banking chatbot, you need to ensure it is effective, secure, and user-friendly. To achieve that, focus on the following aspects:

- Clear purpose. Take time to outline the chatbot’s goals and the problems it aims to solve. This will help set realistic expectations both for your agents and your customers. Define the boundaries of the chatbot’s capabilities to ensure it doesn’t mirror your existing channels.

- Tone of voice. Whether your brand is formal, friendly, or conversational, the chatbot should reflect this tone in its interactions. Steer away from legalese and use language that is empathetic and clear, helping users feel understood and at ease, especially in stressful situations like reporting a lost card.

- Security and privacy. Ensure all data exchanged between the user and the chatbot is encrypted to prevent bad actors from accessing and taking advantage of it. Stick to your local data protection regulations (e.g., GDPR, CCPA) and industry standards to give your customers peace of mind and reassurance that your bot is as trustworthy as your regular bank employee.

- Easy navigation. Provide straightforward menus and options that guide users to their desired actions or information without confusion. Ensure that frequently used functions, such as opening a new account or filing a complaint, are easily accessible through quick commands. Also, it makes sense to add a small self-service FAQ section where users can get more detailed answers and step-by-step guides.

- Agent escalation. Design the chatbot to recognize when it cannot handle a query and automatically escalate it to a human agent without requiring the user to start over. Ensure that all relevant information from the chatbot interaction is transferred to the human agent so the user does not have to repeat themselves.

- Feedback mechanism. Introduce short, context-specific surveys at the end of interactions to evaluate the chatbot’s performance and user satisfaction. Include prompts within the conversation where users can rate responses or comment on the chatbot’s helpfulness in general.

- Promotion strategy. Set up your customers for success by showing them how to use the chatbot and its capabilities through video tutorials and support documentation. Promote the chatbot through various channels to increase adoption and awareness among existing and new users.

Paying attention to these details will help you avoid common pitfalls and ensure that your bot enhances the banking experience for most of your customers.

5 banking chatbot examples to learn from

The following examples of AI chatbots for banking demonstrate how embedding a small chat widget to your website can make all the difference when it comes to customer service and beyond.

Read our recent post to find out diverse

AI chatbot platforms for marketing, support, sales, content production, coding, and more.

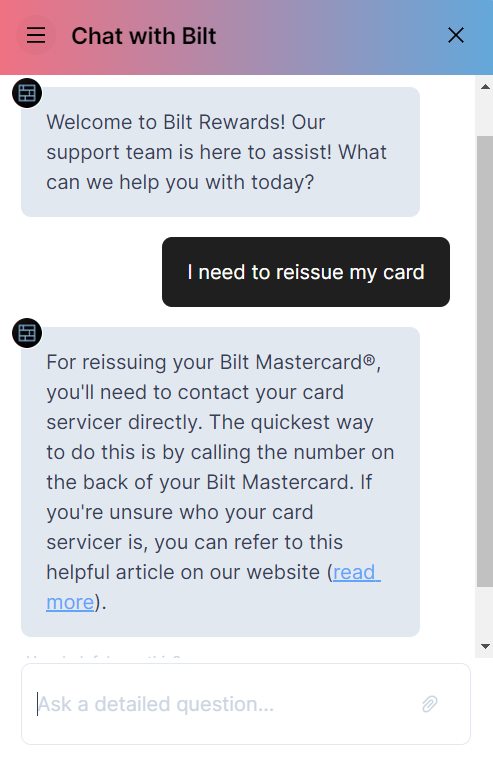

Bilt

Bilt is a loyalty program that helps consumers earn points on their rent payments and access other exclusive member benefits. This revolutionary service requires some getting used to, and that’s why Bilt offers an AI chat ready to assist users with all sorts of inquiries.

The banking chatbot used by Bilt

The banking chatbot used by Bilt

As you can see here, this bot understands free-form commands and provides conversational but concise answers. It also shares useful links to more in-depth resources. Upon opening the widget, the user is prompted to consent to Bilt’s privacy policy, terms, and conditions.

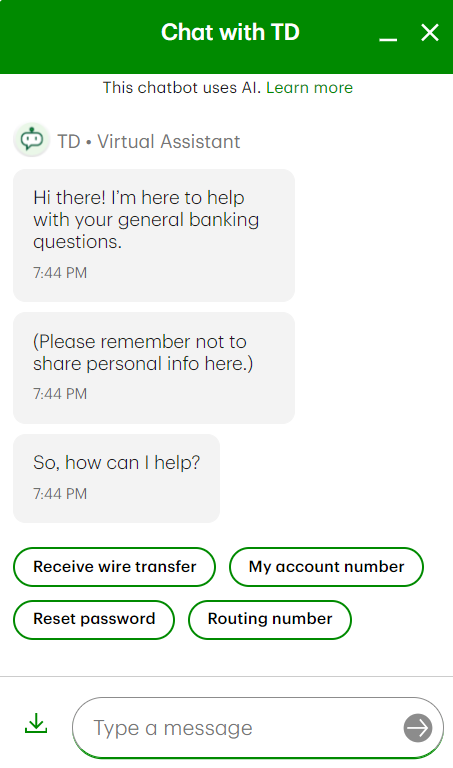

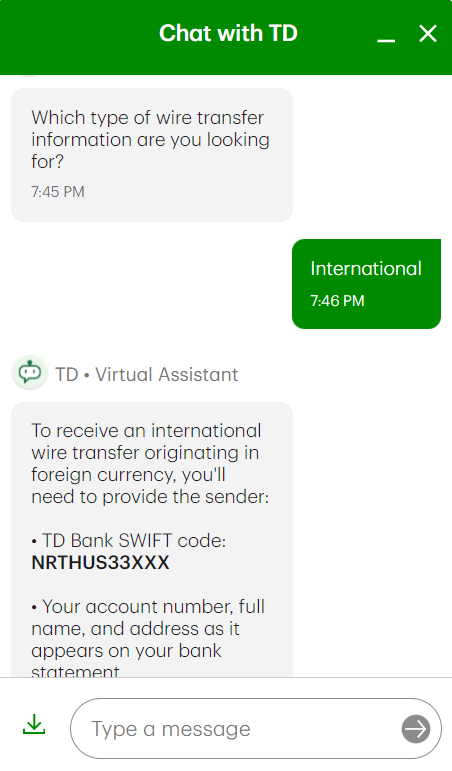

TD Bank

TD Bank is an American national bank that offers banking services, credit cards, loans, home lending, and other financial products. To help consumers navigate its offerings, TD Bank provides them with a variety of tools such as a product selector tool, a knowledge base, and an AI chatbot.

The banking chatbot used by TD Bank

The banking chatbot used by TD Bank

The bot clearly states its purpose in the beginning of each interaction and encourages customers to use quick replies for smoother communication. The widget allows users to upload their files, which is useful for addressing bugs, suspicious transactions, and other nuanced issues.

The bot by TD Bank used for customer support

The bot by TD Bank used for customer support

In addition, the chatbot gives users nicely structured, step-by-step instructions on how to perform certain actions without having to visit the bank in person. The most important information is highlighted for better readability.

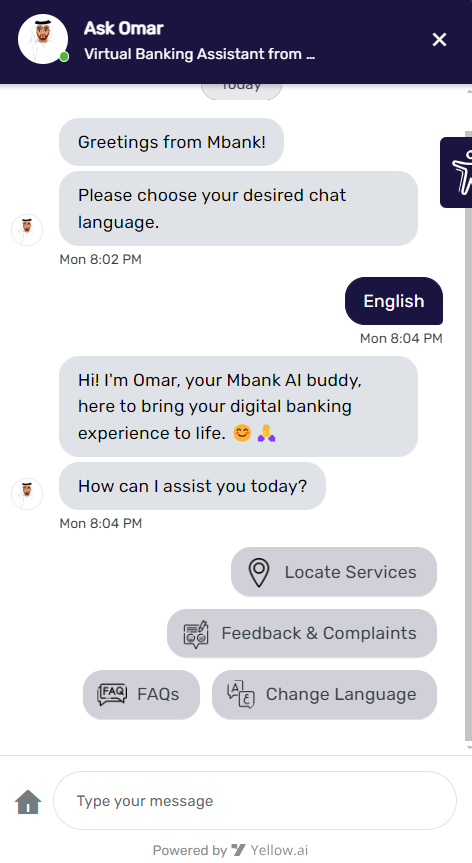

Al Maryah Community Bank

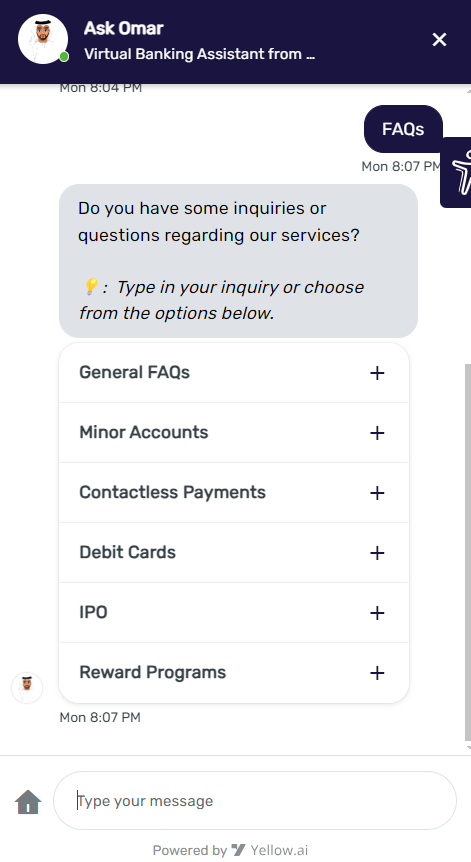

Al Maryah Community Bank is an UAE-based, expat-friendly bank that provides customers with a smooth and secure digital banking experience. The bank’s website features the “Ask Omar” virtual assistant, who delivers multilingual support around the clock.

The virtual assistant used by Al Maryah Community Bank

The virtual assistant used by Al Maryah Community Bank

When it comes to navigation, the bot has a lot to offer, from intuitive commands to the convenient home button. All conversations with Omar are easy to track and review, and the context is preserved even if the user leaves the chat.

The self-service help section within the Al Maryah Community Bank chatbot

The self-service help section within the Al Maryah Community Bank chatbot

This virtual banking assistant also features an easy-to-use help section, where customers can read up more on different programs, cards, accounts, and campaigns the bank currently offers. When appropriate, the bot shares useful links and videos to help users dive deeper into the ecosystem of Al Maryah Community Bank.

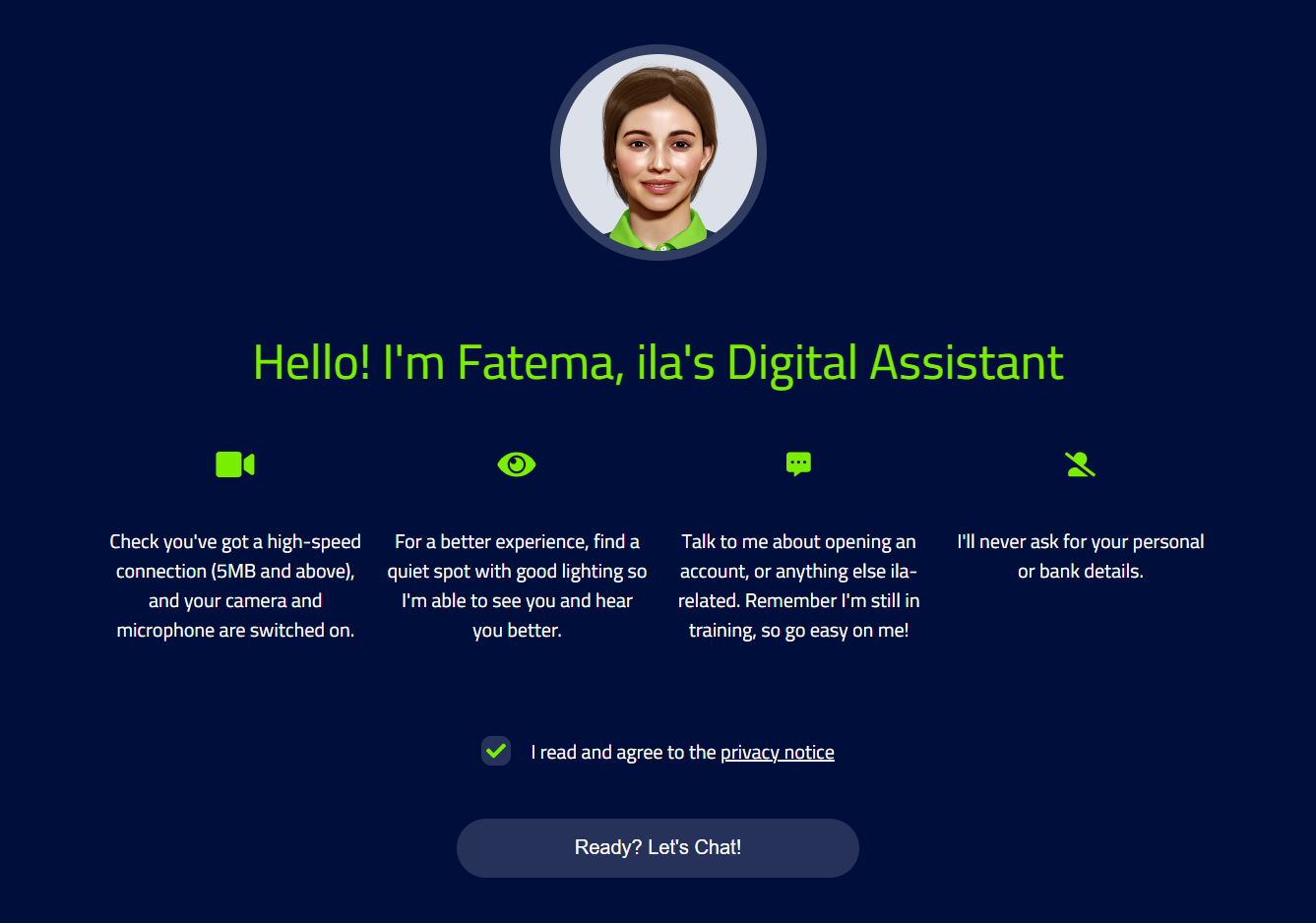

ila Digital Bank

ila is a digital, mobile-first banking solution powered by Bank ABC. The service comes with the advanced AI assistant Fatema, who mimics a real human agent and guides customers through ila’s products via video chat.

Fatema, the AI assistant employed by ila Digital Bank

Fatema, the AI assistant employed by ila Digital Bank

Fatema combines the best of both worlds — it offers the convenience and availability of a banking chatbot paired with the personal and empathic approach of a real agent. The video format allows users to spend less time typing and get to the root of their issues faster. The best part is that the bot learns from every interaction, so the accuracy of its responses will only improve over time.

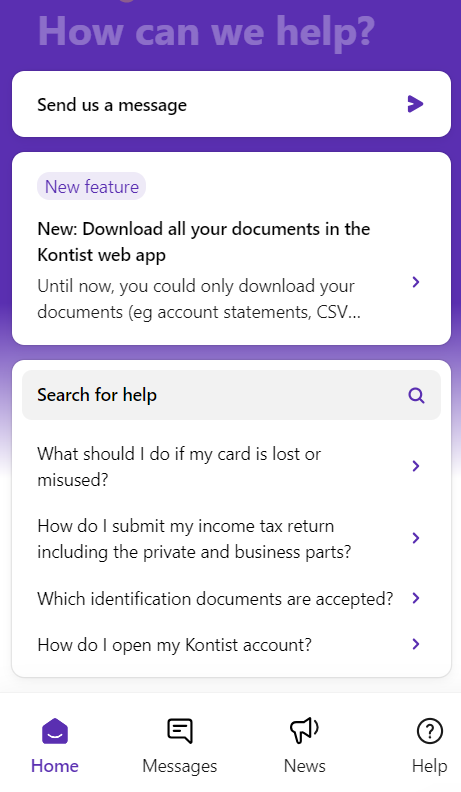

Kontist

Kontist is an AI-enhanced German app for banking, bookkeeping, and business tax returns. New visitors and existing users are encouraged to use the Kontist chatbot, where they can get immediate answers to their banking- and tax-related questions.

The AI chatbot for banking used by Kontist

The AI chatbot for banking used by Kontist

When it comes to support, the bot offers a few options. Firstly, it allows users to learn more about Kontist’s latest features to help them make the most of the app. Then, there’s an option to ask the AI bot or chat with a real agent. In addition, users can take advantage of the detailed built-in FAQ section. Finally, there’s an integrated news feed, which also enables Kontist account holders to stay in the know.

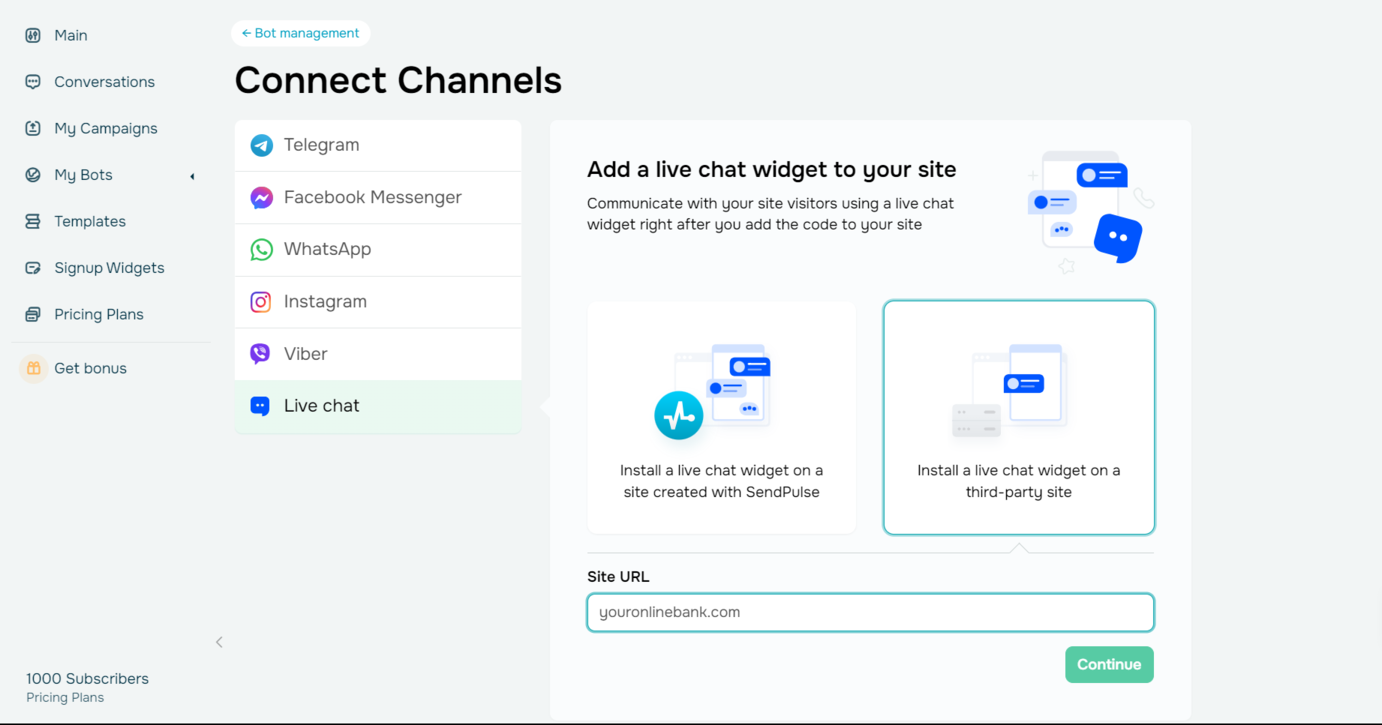

How to create an AI chatbot for banking with SendPulse

With our platform, you can build powerful bots for customer support in minutes — completely code-free. Here’s how it works.

Firstly, log in to your existing SendPulse account or create a new one. Head to the “Chatbots” tab and select “Manage bots.” Choose the desired channel for your chatbot, such as a live chat for websites, and click “Connect.” Copy the installation code and insert it before the closing tag </body> on your site.

Creating a banking chatbot in SendPulse

Creating a banking chatbot in SendPulse

Your live chat widget will have bot capabilities combined with traditional live chat, enabling automated responses to user inquiries and seamless handoffs to human agents when necessary.

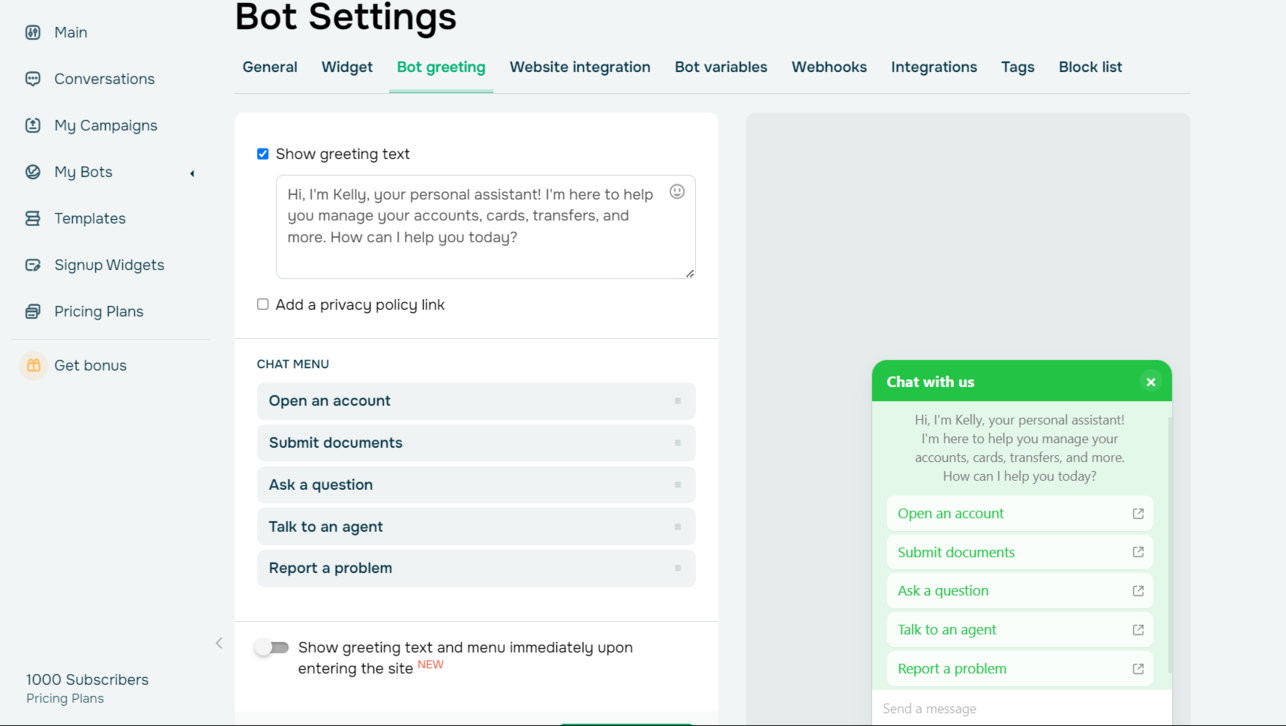

In the bot settings, you can name your virtual assistant and give it a color scheme reflecting that of your brand. There, you can also craft a greeting message that describes the bot’s purpose and informs users on how to navigate it.

Creating a greeting text for a banking chatbot in SendPulse

Creating a greeting text for a banking chatbot in SendPulse

To make your bot more intuitive and easy to navigate, add menu items to it, which will trigger specific flows when users select them. Don’t forget to include an option to “Talk to a live agent” early in the interaction or when introducing your bot.

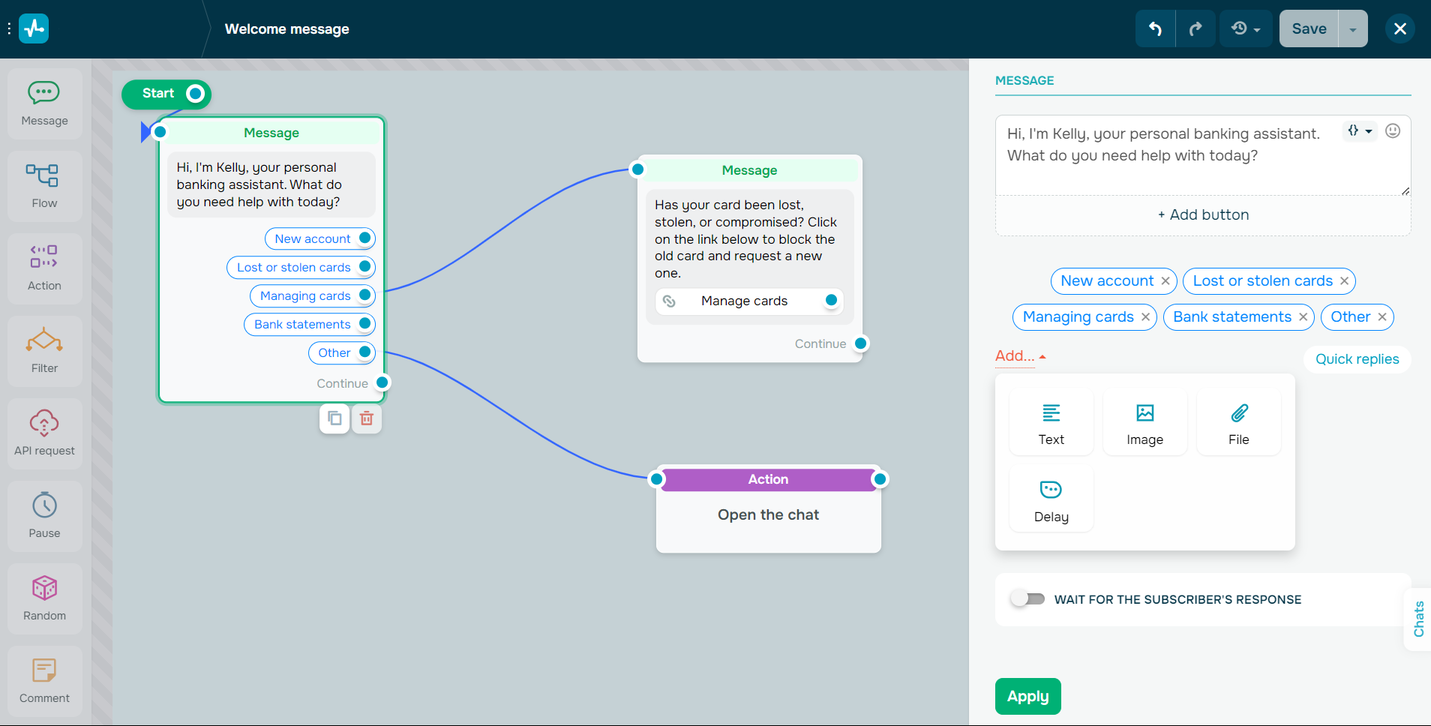

You can also build a complete welcome flow in the “Bot structure” as well as create additional flows and triggers. To enhance your bot, introduce an FAQ section, buttons, and quick replies. The bot messages can also contain variables, emoji, GIFs, images, and other files.

Adding quick replies to the bot’s messages in SendPulse

Adding quick replies to the bot’s messages in SendPulse

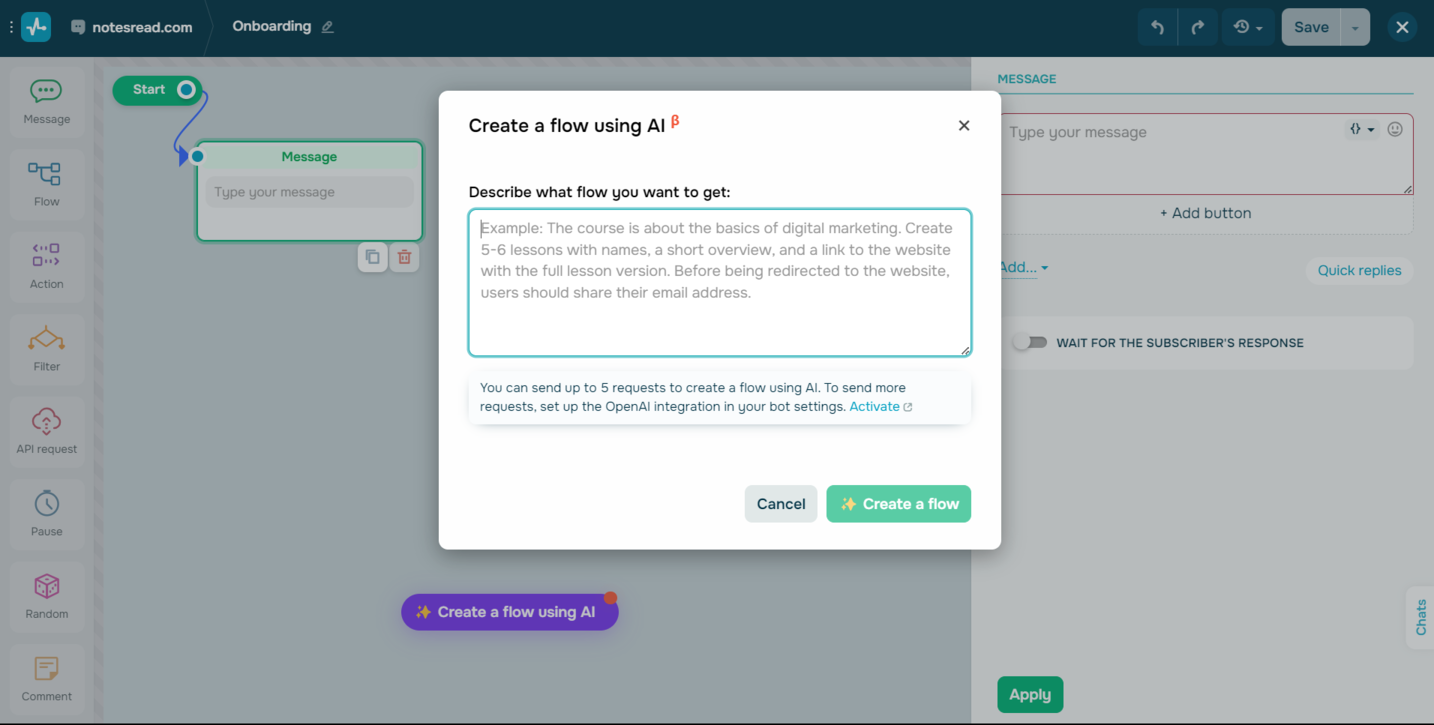

Our visual builder allows you to add elements to your bot’s flows by dragging and dropping them from the sidebar to the workspace. You can also ask AI to create flows for you by simply describing your goals.

Creating chatbot flows with the help of AI

Creating chatbot flows with the help of AI

You may also want to connect ChatGPT to your chatbot to emulate a real agent and accurately follow your bank’s guidelines. It’ll allow your bot to recognize and process complex inquiries, provide human-like, context-based replies, and learn from each interaction. This integration is available with a paid plan.

All you need to do is choose an AI model and add prompts to set limitations. Feed your bot detailed info about your financial services or products beforehand, ensuring it has a rich context base to draw from.

With SendPulse, you can create AI-powered banking chatbots for your website, WhatsApp, Telegram, Facebook, and Instagram. It’s possible to have up to three bots and send up to 10,000 messages monthly for free. The pricing plans start at $10 a month, billed monthly. Paying annually can save you 20%.

Unlock the power of chatbots for financial services today

SendPulse offers a comprehensive marketing and sales automation ecosystem, including a chatbot builder, website builder, CRM, pop-up builder, SMS service, and LMS. Our platform comes with an intuitive help center along with 24/7 support.

Get your free account now and uncover the full potential of our toolkit!